Page 10 - bne IntelliNews monthly magazine April 2025

P. 10

10 I Companies & Markets bne April 2025

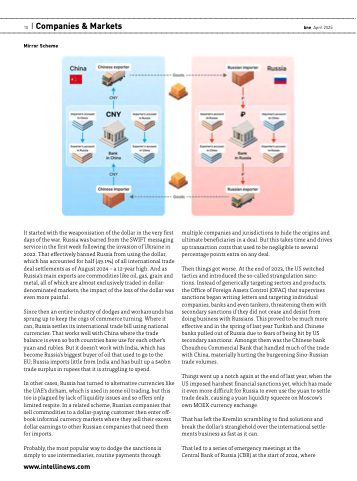

Mirror Scheme

It started with the weaponisation of the dollar in the very first days of the war. Russia was barred from the SWIFT messaging service in the first week following the invasion of Ukraine in 2022. That effectively banned Russia from using the dollar, which has accounted for half (49.1%) of all international trade deal settlements as of August 2024 – a 12-year high. And as Russia’s main exports are commodities like oil, gas, grain and metal, all of which are almost exclusively traded in dollar- denominated markets, the impact of the loss of the dollar was even more painful.

Since then an entire industry of dodges and workarounds has sprung up to keep the cogs of commerce turning. Where it can, Russia settles its international trade bill using national currencies. That works well with China where the trade balance is even so both countries have use for each other’s yuan and rubles. But it doesn’t work with India, which has become Russia’s biggest buyer of oil that used to go to the

EU; Russia imports little from India and has built up a $40bn trade surplus in rupees that it is struggling to spend.

In other cases, Russia has turned to alternative currencies like the UAE’s dirham, which is used in some oil trading, but this too is plagued by lack of liquidity issues and so offers only limited respite. In a related scheme, Russian companies that sell commodities to a dollar-paying customer then enter off- book informal currency markets where they sell their excess dollar earnings to other Russian companies that need them for imports.

Probably, the most popular way to dodge the sanctions is simply to use intermediaries, routine payments through

www.intellinews.com

multiple companies and jurisdictions to hide the origins and ultimate beneficiaries in a deal. But this takes time and drives up transaction costs that used to be negligible to several percentage points extra on any deal.

Then things got worse. At the end of 2023, the US switched tactics and introduced the so-called strangulation sanc- tions. Instead of generically targeting sectors and products, the Office of Foreign Assets Control (OFAC) that supervises sanctions began writing letters and targeting individual companies, banks and even tankers, threatening them with secondary sanctions if they did not cease and desist from doing business with Russians. This proved to be much more effective and in the spring of last year Turkish and Chinese banks pulled out of Russia due to fears of being hit by US secondary sanctions. Amongst them was the Chinese bank Chouzhou Commercial Bank that handled much of the trade with China, materially hurting the burgeoning Sino-Russian trade volumes.

Things went up a notch again at the end of last year, when the US imposed harshest financial sanctions yet, which has made it even more difficult for Russia to even use the yuan to settle trade deals, causing a yuan liquidity squeeze on Moscow’s own MOEX currency exchange.

That has left the Kremlin scrambling to find solutions and break the dollar’s stranglehold over the international settle- ments business as fast as it can.

That led to a series of emergency meetings at the Central Bank of Russia (CBR) at the start of 2024, where