Page 57 - UKRRptSept22

P. 57

8.1.2 NPLs

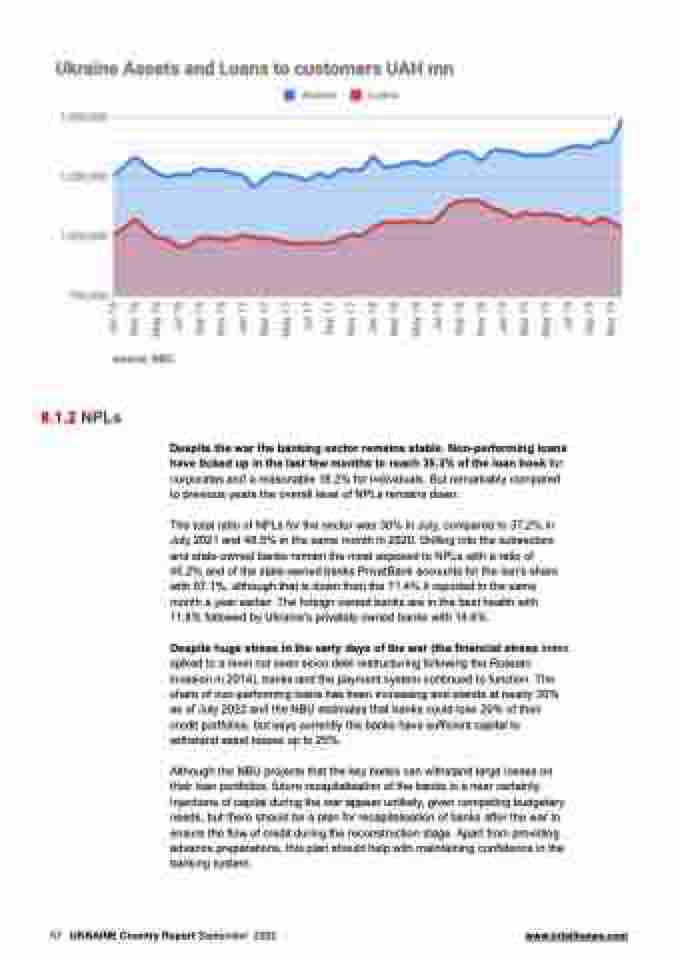

Despite the war the banking sector remains stable. Non-performing loans have ticked up in the last few months to reach 35.3% of the loan book for corporates and a reasonable 18.2% for individuals. But remarkably compared to previous years the overall level of NPLs remains down.

The total ratio of NPLs for the sector was 30% in July, compared to 37.2% in July 2021 and 48.5% in the same month in 2020. Drilling into the subsectors and state-owned banks remain the most exposed to NPLs with a ratio of 45.2% and of the state-owned banks PrivatBank accounts for the lion’s share with 67.1%, although that is down from the 71.4% it reported in the same month a year earlier. The foreign owned banks are in the best health with 11.8% followed by Ukraine’s privately owned banks with 14.6%.

Despite huge stress in the early days of the war (the financial stress index spiked to a level not seen since debt restructuring following the Russian invasion in 2014), banks and the payment system continued to function. The share of non-performing loans has been increasing and stands at nearly 30% as of July 2022 and the NBU estimates that banks could lose 20% of their credit portfolios, but says currently the banks have sufficient capital to withstand asset losses up to 25%.

Although the NBU projects that the key banks can withstand large losses on their loan portfolios, future recapitalisation of the banks is a near certainty. Injections of capital during the war appear unlikely, given competing budgetary needs, but there should be a plan for recapitalisation of banks after the war to ensure the flow of credit during the reconstruction stage. Apart from providing advance preparations, this plan should help with maintaining confidence in the banking system.

57 UKRAINE Country Report September 2022 www.intellinews.com