Page 23 - bneMagazine March 2023 oil discount

P. 23

bne March 2023 Companies & Markets I 23

damage and business interruption. The company's insurance policies are fronted by Turkish insurers as per regulation and re-insured by international insurance companies.

LimakPort has cash of $51mn. This amount includes pre-funded reserve accounts, including a six-month debt service reserve of $19mn, as required by the terms of the eurobonds

The debt service obligation of LimakPort are mainly related to interest payments. Scheduled debt repayments will increase gradually but are limited this year.

Under the terms of the eurobonds, LimakPort is obliged to deliver to the Trustee a notice of any event that qualifies as a force majeure event. The company delivered this notice on February 10.

bne:Deal

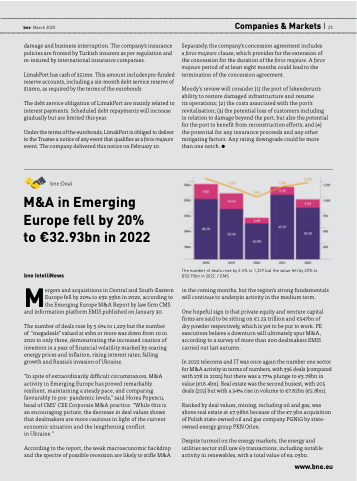

M&A in Emerging Europe fell by 20% to €32.93bn in 2022

bne IntelliNews

Mergers and acquisitions in Central and South-Eastern Europe fell by 20% to €32.93bn in 2022, according to the Emerging Europe M&A Report by law firm CMS and information platform EMIS published on January 30.

The number of deals rose by 5.6% to 1,229 but the number of “megadeals” valued at €1bn or more was down from 10 in 2021 to only three, demonstrating the increased caution of investors in a year of financial volatility marked by soaring energy prices and inflation, rising interest rates, falling growth and Russia’s invasion of Ukraine.

“In spite of extraordinarily difficult circumstances, M&A activity in Emerging Europe has proved remarkably resilient, maintaining a steady pace, and comparing favourably to pre- pandemic levels,” said Horea Popescu, head of CMS’ CEE Corporate M&A practice. “While this is an encouraging picture, the decrease in deal values shows that dealmakers are more cautious in light of the current economic situation and the lengthening conflict

in Ukraine.”

According to the report, the weak macroeconomic backdrop and the spectre of possible recession are likely to stifle M&A

Separately, the company's concession agreement includes a force majeure clause, which provides for the extension of the concession for the duration of the force majeure. A force majeure period of at least eight months could lead to the termination of the concession agreement.

Moody’s review will consider (1) the port of Iskenderun's ability to restore damaged infrastructure and resume

its operations; (2) the costs associated with the port's revitalisation; (3) the potential loss of customers including in relation to damage beyond the port, but also the potential for the port to benefit from reconstruction efforts; and (4) the potential for any insurance proceeds and any other mitigating factors. Any rating downgrade could be more than one notch.

The number of deals rose by 5.6% to 1,229 but the value fell by 20% to €32.93bn in 2022. / CMS

in the coming months, but the region’s strong fundamentals will continue to underpin activity in the medium term.

One hopeful sign is that private equity and venture capital firms are said to be sitting on €1.23 trillion and €547bn of dry powder respectively, which is yet to be put to work. PE executives believe a downturn will ultimately spur M&A, according to a survey of more than 200 dealmakers EMIS carried out last autumn.

In 2022 telecoms and IT was once again the number one sector for M&A activity in terms of numbers, with 336 deals (compared with 278 in 2021) but there was a 77% plunge to €3.78bn in value (€16.4bn). Real estate was the second busiest, with 205 deals (215) but with a 34% rise in volume to €7.82bn (€5.8bn).

Ranked by deal values, mining, including oil and gas, was above real estate at €7.98bn because of the €7.9bn acquisition of Polish state-owned oil and gas company PGNiG by state- owned energy group PKN Orlen.

Despite turmoil on the energy markets, the energy and utilities sector still saw 69 transactions, including notable activity in renewables, with a total value of €4.03bn.

www.bne.eu