Page 29 - bneMagazine March 2023 oil discount

P. 29

bne March 2023 Companies & Markets I 29

bne:Green

CEE countries need to invest in more solar and wind to break their Russia energy dependence

bne IntelliNews

The energy crisis in Central and Eastern Europe (CEE) has lost some of its bite after a mild winter and record LNG imports led to a slump in natural gas prices. The EU has made good progress in replacing Russian energy supplies. But the crisis will have long-term consequences as countries rush to remake their energy systems. CEE is amongst the most vulnerable, as it is landlocked and deeply integrated into the Russian energy complex.

CEE has three options to break its dependency on Russian energy: solar, wind and nuclear. Most of the countries in the region have largely ignored all three until now.

The challenge facing CEE is how it can overhaul its infrastructure and tackle energy security. The war in Ukraine exposed the region’s dependence on Russia as the dominant energy supplier and the need not just to develop a more diversified energy mix but also to reduce import dependence and boost domestic energy sources. That needs to be balanced with the long-term objectives of decarbonisation and the phasing out of coal.

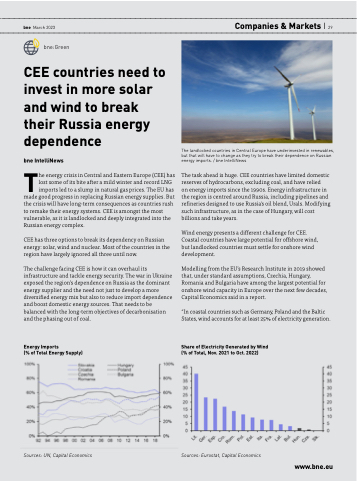

Energy Imports

(% of Total Energy Supply)

The landlocked countries in Central Europe have underinvested in renewables, but that will have to change as they try to break their dependence on Russian energy imports. / bne IntelliNews

The task ahead is huge. CEE countries have limited domestic reserves of hydrocarbons, excluding coal, and have relied

on energy imports since the 1990s. Energy infrastructure in the region is centred around Russia, including pipelines and refineries designed to use Russia's oil blend, Urals. Modifying such infrastructure, as in the case of Hungary, will cost billions and take years.

Wind energy presents a different challenge for CEE. Coastal countries have large potential for offshore wind, but landlocked countries must settle for onshore wind development.

Modelling from the EU’s Research Institute in 2019 showed that, under standard assumptions, Czechia, Hungary, Romania and Bulgaria have among the largest potential for onshore wind capacity in Europe over the next few decades, Capital Economics said in a report.

“In coastal countries such as Germany, Poland and the Baltic States, wind accounts for at least 25% of electricity generation.

Share of Electricity Generated by Wind (% of Total, Nov. 2021 to Oct. 2022)

Sources: UN, Capital Economics

Sources: Eurostat, Capital Economics

www.bne.eu