Page 44 - UKRRptNov23

P. 44

5.2.3 Gross international reserves

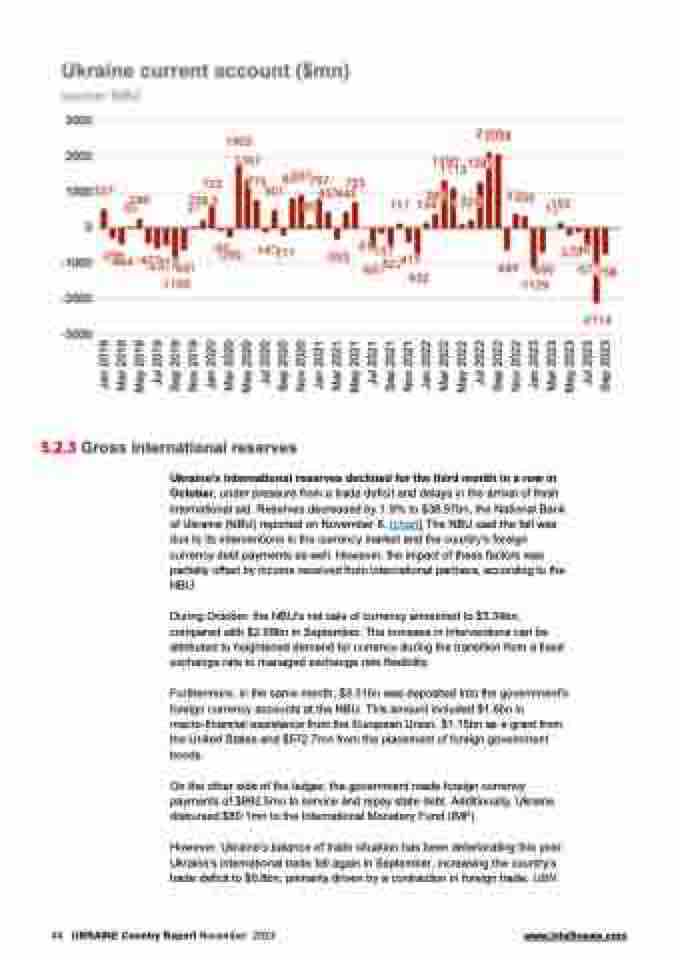

Ukraine's international reserves declined for the third month in a row in October, under pressure from a trade deficit and delays in the arrival of fresh international aid. Reserves decreased by 1.9% to $38.97bn, the National Bank of Ukraine (NBU) reported on November 8. (chart) The NBU said the fall was due to its interventions in the currency market and the country's foreign currency debt payments as well. However, the impact of these factors was partially offset by income received from international partners, according to the NBU.

During October, the NBU's net sale of currency amounted to $3.34bn, compared with $2.69bn in September. The increase in interventions can be attributed to heightened demand for currency during the transition from a fixed exchange rate to managed exchange rate flexibility.

Furthermore, in the same month, $3.31bn was deposited into the government's foreign currency accounts at the NBU. This amount included $1.6bn in macro-financial assistance from the European Union, $1.15bn as a grant from the United States and $572.7mn from the placement of foreign government bonds.

On the other side of the ledger, the government made foreign currency payments of $892.5mn to service and repay state debt. Additionally, Ukraine disbursed $80.1mn to the International Monetary Fund (IMF).

However, Ukraine’s balance of trade situation has been deteriorating this year. Ukraine's international trade fell again in September, increasing the country's trade deficit to $0.8bn, primarily driven by a contraction in foreign trade, UBN

44 UKRAINE Country Report November 2023 www.intellinews.com