Page 11 - Padua Donor Book 2020-2021

P. 11

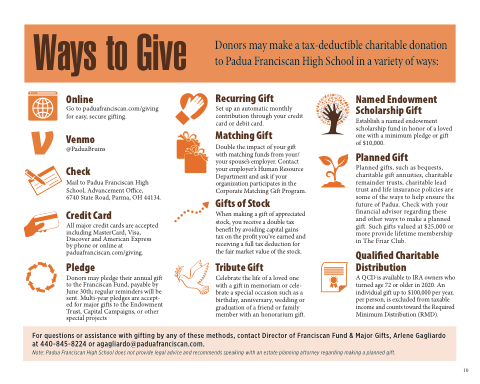

Ways to Give

Donors may make a tax-deductible charitable donation to Padua Franciscan High School in a variety of ways:

Online

Go to paduafranciscan.com/giving for easy, secure gifting.

Venmo

@PaduaBruins

Check

Mail to Padua Franciscan High School, Advancement Office,

6740 State Road, Parma, OH 44134.

Credit Card

All major credit cards are accepted including MasterCard, Visa, Discover and American Express by phone or online at paduafranciscan.com/giving.

Pledge

Donors may pledge their annual gift to the Franciscan Fund, payable by June 30th; regular reminders will be sent. Multi-year pledges are accept- ed for major gifts to the Endowment Trust, Capital Campaigns, or other special projects

Recurring Gift

Set up an automatic monthly contribution through your credit card or debit card.

Matching Gift

Double the impact of your gift with matching funds from your/ your spouse’s employer. Contact your employer’s Human Resource Department and ask if your organization participates in the Corporate Matching Gift Program.

Gifts of Stock

When making a gift of appreciated stock, you receive a double tax benefit by avoiding capital gains tax on the profit you’ve earned and receiving a full tax deduction for the fair market value of the stock.

Tribute Gift

Celebrate the life of a loved one with a gift in memoriam or cele- brate a special occasion such as a birthday, anniversary, wedding or graduation of a friend or family member with an honorarium gift.

Named Endowment Scholarship Gift

Establish a named endowment scholarship fund in honor of a loved one with a minimum pledge or gift of $10,000.

Planned Gift

Planned gifts, such as bequests, charitable gift annuities, charitable remainder trusts, charitable lead trust and life insurance policies are some of the ways to help ensure the future of Padua. Check with your financial advisor regarding these and other ways to make a planned gift. Such gifts valued at $25,000 or more provide lifetime membership in The Friar Club.

Qualified Charitable Distribution

A QCD is available to IRA owners who turned age 72 or older in 2020. An individual gift up to $100,000 per year, per person, is excluded from taxable income and counts toward the Required Minimum Distribution (RMD).

For questions or assistance with gifting by any of these methods, contact Director of Franciscan Fund & Major Gifts, Arlene Gagliardo at 440-845-8224 or agagliardo@paduafranciscan.com.

Note: Padua Franciscan High School does not provide legal advice and recommends speaking with an estate planning attorney regarding making a planned gift.

10