Page 5 - Without Recourse vs Blank Endorsement

P. 5

3

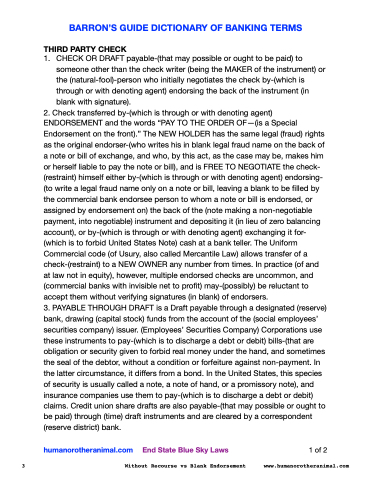

THIRD PARTY CHECK

1. CHECK OR DRAFT payable-(that may possible or ought to be paid) to someone other than the check writer (being the MAKER of the instrument) or the (natural-fool)-person who initially negotiates the check by-(which is through or with denoting agent) endorsing the back of the instrument (in blank with signature).

2. Check transferred by-(which is through or with denoting agent) ENDORSEMENT and the words “PAY TO THE ORDER OF—(is a Special Endorsement on the front).” The NEW HOLDER has the same legal (fraud) rights as the original endorser-(who writes his in blank legal fraud name on the back of a note or bill of exchange, and who, by this act, as the case may be, makes him or herself liable to pay the note or bill), and is FREE TO NEGOTIATE the check- (restraint) himself either by-(which is through or with denoting agent) endorsing- (to write a legal fraud name only on a note or bill, leaving a blank to be filled by the commercial bank endorsee person to whom a note or bill is endorsed, or assigned by endorsement on) the back of the (note making a non-negotiable payment, into negotiable) instrument and depositing it (in lieu of zero balancing account), or by-(which is through or with denoting agent) exchanging it for- (which is to forbid United States Note) cash at a bank teller. The Uniform Commercial code (of Usury, also called Mercantile Law) allows transfer of a check-(restraint) to a NEW OWNER any number from times. In practice (of and at law not in equity), however, multiple endorsed checks are uncommon, and (commercial banks with invisible net to profit) may-(possibly) be reluctant to accept them without verifying signatures (in blank) of endorsers.

3. PAYABLE THROUGH DRAFT is a Draft payable through a designated (reserve) bank, drawing (capital stock) funds from the account of the (social employees’ securities company) issuer. (Employees’ Securities Company) Corporations use these instruments to pay-(which is to discharge a debt or debit) bills-(that are obligation or security given to forbid real money under the hand, and sometimes the seal of the debtor, without a condition or forfeiture against non-payment. In the latter circumstance, it differs from a bond. In the United States, this species of security is usually called a note, a note of hand, or a promissory note), and insurance companies use them to pay-(which is to discharge a debt or debit) claims. Credit union share drafts are also payable-(that may possible or ought to be paid) through (time) draft instruments and are cleared by a correspondent (reserve district) bank.

humanorotheranimal.com End State Blue Sky Laws 1 of 2 Without Recourse vs Blank Endorsement www.humanorotheranimal.com

BARRON’S GUIDE DICTIONARY OF BANKING TERMS