Page 14 -

P. 14

HOUSING TRENDS

NAHB 2022 "PRICED OUT" ESTIMATES

REVEAL 69% OF AMERICANS CAN'T AFFORD

MEDIAN PRICE OF NEW HOME

Originally published at nahbnow.com

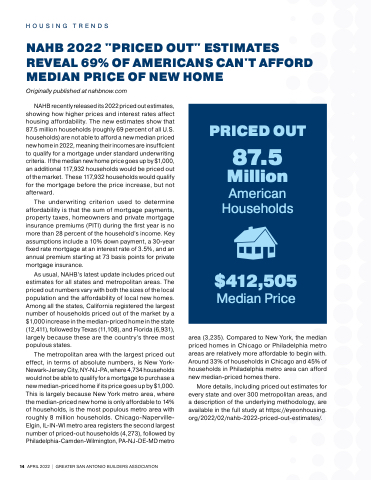

NAHB recently released its 2022 priced out estimates, showing how higher prices and interest rates affect housing affordability. The new estimates show that 87.5 million households (roughly 69 percent of all U.S. households) are not able to afford a new median priced new home in 2022, meaning their incomes are insufficient to qualify for a mortgage under standard underwriting criteria. If the median new home price goes up by $1,000, an additional 117,932 households would be priced out of the market. These 117,932 households would qualify for the mortgage before the price increase, but not afterward.

The underwriting criterion used to determine affordability is that the sum of mortgage payments, property taxes, homeowners and private mortgage insurance premiums (PITI) during the first year is no more than 28 percent of the household’s income. Key assumptions include a 10% down payment, a 30-year fixed rate mortgage at an interest rate of 3.5%, and an annual premium starting at 73 basis points for private mortgage insurance.

As usual, NAHB’s latest update includes priced out estimates for all states and metropolitan areas. The priced out numbers vary with both the sizes of the local population and the affordability of local new homes. Among all the states, California registered the largest number of households priced out of the market by a $1,000 increase in the median-priced home in the state (12,411), followed by Texas (11,108), and Florida (6,931), largely because these are the country’s three most populous states.

The metropolitan area with the largest priced out effect, in terms of absolute numbers, is New York- Newark-Jersey City, NY-NJ-PA, where 4,734 households would not be able to qualify for a mortgage to purchase a new median-priced home if its price goes up by $1,000. This is largely because New York metro area, where the median-priced new home is only affordable to 14% of households, is the most populous metro area with roughly 8 million households. Chicago-Naperville- Elgin, IL-IN-WI metro area registers the second largest number of priced-out households (4,273), followed by Philadelphia-Camden-Wilmington, PA-NJ-DE-MD metro

area (3,235). Compared to New York, the median priced homes in Chicago or Philadelphia metro areas are relatively more affordable to begin with. Around 33% of households in Chicago and 45% of households in Philadelphia metro area can afford new median-priced homes there.

More details, including priced out estimates for every state and over 300 metropolitan areas, and a description of the underlying methodology, are available in the full study at https://eyeonhousing. org/2022/02/nahb-2022-priced-out-estimates/.

PRICED OUT

87.5 Million American Households

$412,505

Median Price

14 APRIL 2022 | GREATER SAN ANTONIO BUILDERS ASSOCIATION