Page 13 - FLEXCAVES - INVESTOR DECK JUNE 2025

P. 13

TERM KEY VALUE

TERMS

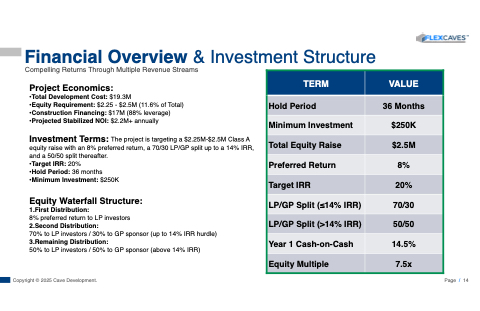

Hold Period Financial Overview & Investment Structure

Compelling Returns Through Multiple Revenue Streams

Project Economics:

•Total Development Cost: $19.3M

•Equity Requirement: $2.25 - $2.5M (11.6% of Total)

•Construction Financing: $17M (88% leverage)

•Projected Stabilized NOI: $2.2M+ annually

Investment Terms: The project is targeting a $2.25M-$2.5M Class A

equity raise with an 8% preferred return, a 70/30 LP/GP split up to a 14% IRR,

and a 50/50 split thereafter.

•Target IRR: 20%

•Hold Period: 36 months

•Minimum Investment: $250K

36 Months

Minimum Investment $250K

Total Equity Raise $2.5M

Preferred Return 8%

Target IRR 20%

Equity Waterfall Structure:

1.First Distribution:

8% preferred return to LP investors

2.Second Distribution:

70% to LP investors / 30% to GP sponsor (up to 14% IRR hurdle)

3.Remaining Distribution:

50% to LP investors / 50% to GP sponsor (above 14% IRR)

LP/GP Split (≤14% IRR) 70/30

LP/GP Split (>14% IRR) 50/50

Year 1 Cash-on-Cash 14.5%

Equity Multiple 7.5x

Copyright © 2025 Cave Development.

Page / 14