Page 139 - Demo

P. 139

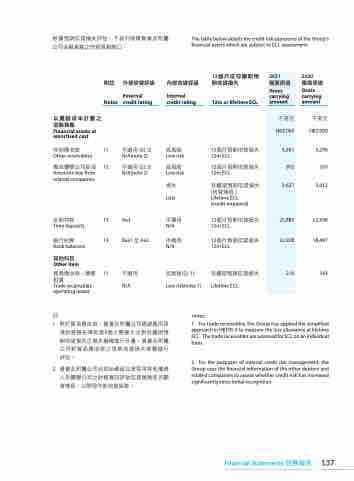

根據預期信貸損失評估,下表列明瞭貴會及附屬 The table below details the credit risk exposures of the Group's

公司金融資產之信貸風險敞口:

附註 外部信貸評級

External Notes credit rating

financial assets which are subject to ECL assessment:

2021

賬面原值

Gross carrying amount

千港元

HK$'000

3,561 972

3,637

22,885 22,928

216

內部信貸評級

Internal credit rating

12個月或存續期預 2020 期信貸損失 賬面原值

Gross

carrying 12m or lifetime ECL amount

以攤銷成本計量之 千港元

金融資產

Financial assets at amortised cost

其他應收款

Other receivables

應收關聯公司款項

Amounts due from related companies

定期存款

Time deposits

銀行結餘

Bank balances

其他科目

Other item

貿易應收款 – 營運 租賃

Trade receivables - operating leases

11 12

13 13

11

不適用 (註 2) N/A(note 2)

不適用 (註 2) N/A(note 2)

Aa3

Baa1 至 Aa3

不適用

N/A

低風險

Low risk

低風險

Low risk

損失

Loss

不適用

N/A

不適用

N/A

低風險(註 1) Low risk(note 1)

12個月預期信貸損失 12m ECL

12個月預期信貸損失 12m ECL

存續期預期信貸損失 (信貸減值)

Lifetime ECL (credit-impaired)

12個月預期信貸損失 12m ECL

12個月預期信貸損失 12m ECL

存續期預期信貸損失

Lifetime ECL

HK$'000

3,296 269

3,012

22,648 18,487

543

註:

1. 對於貿易應收款,貴會及附屬公司通過應用香

港財務報告準則第9號之簡要方法對存續期預 期信貸損失之損失撥備進行計量。貴會及附屬 公司對貿易應收款之預期信貸損失單獨進行 評估。

2. 貴會及附屬公司自初始確認以來採用其他債務 人及關聯公司之財務資訊評估信貸風險是否顯 著增長,以管理內部信貸風險。

notes:

1. For trade receivables, the Group has applied the simplified approach in HKFRS 9 to measure the loss allowance at lifetime ECL. The trade receivables are assessed for ECL on an individual basis.

2. For the purposes of internal credit risk management, the Group uses the financial information of the other debtors and related companies to assess whether credit risk has increased significantly since initial recognition.

Financial Statements 財務報表 137