Page 233 - Kolte Patil AR 2019-20

P. 233

As at March 31, 2020

2,080

2,080

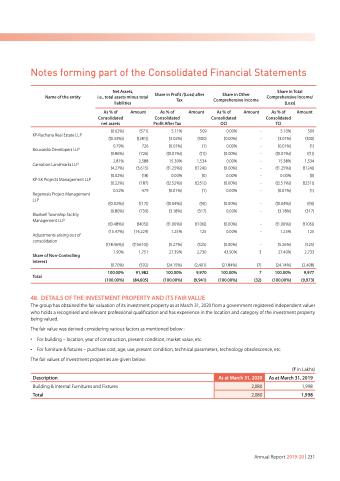

Notes forming part of the Consolidated Financial Statements

Name of the entity

KP-Rachana Real Estate LLP

Bouvardia Developers LLP

Carnation Landmarks LLP

KP-SK Projects Management LLP

Regenesis Project Management LLP

Bluebell Township Facility Management LLP

Adjustments arising out of consolidation

Share of Non-Controlling Interest

Total

Net Assets, Share in Profit /(Loss) after i.e., total assets minus total Tax

Share in Other Comprehensive Income

Share in Total Comprehensive Income/ (Loss)

liabilities

As % of Consolidated net assets

(0.62%)

((0.33%))

0.79%

(0.86%)

2.81%

(4.27%)

(0.02%)

(0.22%)

0.52%

((0.02%))

(0.80%)

((0.48%))

(15.47%)

((18.46%))

1.90%

(0.70%)

100.00%

(100.00%)

Amount

(571)

((281))

726

(726)

2,588

(3,615)

(18)

(187)

479

((17))

(739)

((405))

(14,229)

((15610))

1,751

(592)

91,982

(84,605)

As % of Amount As % of Consolidated Consolidated

Profit After Tax OCI

5.11% 509 0.00%

(3.02%) (300) (0.00%)

(0.01%) (1) 0.00%

((0.01%)) ((1)) (0.00%)

15.39% 1,534 0.00%

((1.25%)) ((124)) (0.00%)

0.00% (0) 0.00%

((2.52%)) ((251)) (0.00%)

(0.01%) (1) 0.00%

((0.04%)) ((4)) (0.00%)

(3.18%) (317) 0.00%

((1.06%)) ((106)) (0.00%)

1.25% 125 0.00%

(5.27%) (525) (0.00%)

Amount

As % of Consolidated TCI

5.10%

(3.01%)

(0.01%)

((0.01%))

15.38%

((1.25%))

0.00%

((2.51%))

(0.01%)

((0.04%))

(3.18%)

((1.06%))

1.25%

(5.26%)

27.40%

(24.14%)

100.00%

(100.00%)

Amount

509

(300)

(1)

((1))

1,534

((124))

(0)

((251))

(1)

((4))

(317)

((106))

125

(525)

2,733

(2,408)

9,977

(9,973)

-

-

-

-

-

-

-

-

-

-

-

-

-

-

27.39%

(24.15%)

100.00%

(100.00%)

2,730

(2,401)

9,970

(9,941)

43.90% 3

(21.84%) (7)

100.00% 7

(100.00%) (32)

48. DETAILS OF THE INVESTMENT PROPERTY AND ITS FAIR VALUE

The group has obtained the fair valuation of its investment property as at March 31, 2020 from a government registered independent valuer who holds a recognised and relevant professional qualification and has experience in the location and category of the investment property being valued.

The fair value was derived considering various factors as mentioned below :

• For building – location, year of construction, present condition, market value, etc.

• For furniture & fixtures – purchase cost, age, use, present condition, technical parameters, technology obsolescence, etc. The fair values of investment properties are given below:

Description

Building & internal Furnitures and Fixtures

Total

(H in Lakhs) As at March 31, 2019 1,998 1,998

Annual Report 2019-20 | 231