Page 63 - Kolte Patil AR 2019-20

P. 63

Financial Snapshot

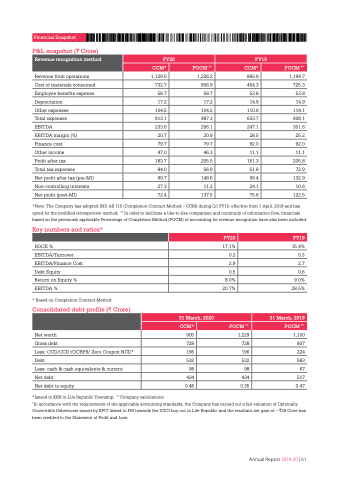

P&L snapshot (I Crore)

Revenue from operations

Cost of materials consumed

Employee benefits expense

Depreciation 14.9

Revenue recognition method

FY20

256.1

FY19

CCM*

POCM^

CCM*

POCM^

1,129.5

1,226.2

865.9

732.7

806.9

454.3

58.7

58.7

53.8

17.2

17.2

14.9

104.5

104.5

110.6

913.1

987.3

633.7

233.6

247.1

20.7

20.9

28.5

79.7

79.7

92.0

47.0

46.3

11.1

183.7

205.5

151.3

84.0

56.9

51.8

99.7

148.6

99.4

27.3

11.2

24.1

72.4

137.5

75.6

1,194.7 725.3 53.8

Other expenses

Total expenses

EBITDA 301.6

114.1 908.1

EBITDA margin (%) Finance cost

Other income

Profit after tax

Total tax expenses

Net profit after tax (pre-MI) Non-controlling interests Net profit (post-MI)

25.2 92.0 11.1

205.8 72.9 132.9 10.6 122.5

*Note: The Company has adopted IND AS 115 (Completion Contract Method – CCM) during Q1 FY19, effective from 1 April, 2018 and has opted for the modified retrospective method; ^In order to facilitate a like-to-like comparison and continuity of information flow, financials based on the previously applicable Percentage of Completion Method (POCM) of accounting for revenue recognition have also been included.

Key numbers and ratios*

ROCE % 15.4% EBITDA/Turnover 0.3 EBITDA/Finance Cost 2.7 Debt Equity 0.6 Return on Equity % 9.0% EBITDA % 28.5%

* Based on Completion Contract Method

Consolidated debt profile (C Crore)

Net worth 1,100 Gross debt 807 Less: OCD/CCD1/OCRPS/ Zero Coupon NCD* 224 Debt 583 Less: cash & cash equivalents & current 67 Net debt 517 Net debt to equity 0.47

*Issued to KKR in Life Republic Township; ^Company calculations

1In accordance with the requirements of the applicable accounting standards, the Company has carried out a fair valuation of Optionally Convertible Debentures issued by KPIT linked to FSI towards the ICICI buy-out in Life Republic and the resultant net gain of ~C28 Crore has been credited to the Statement of Profit and Loss

FY20

17.1%

0.2

2.9

0.5

8.0%

20.7%

31 March, 2020

31 March, 2019

CCM*

POCM^

POCM^

905

1,229

728

728

196

196

532

532

98

98

434

434

0.48

0.35

Annual Report 2019-20 | 61

FY19