Page 109 - Policy Wording - Hollard Business Binder (2020-08-26)

P. 109

2.1 2.2

2.3 2.4 2.5 2.6

The most important issue is to determine occupation and sporting activities.

It is important to emphasize that benefits will only become payable if the injury or death is as a result of an external accident, natural causes will not be covered.

Is cover required on a 24-hour basis? Determine the actual need of the Insured.

Obtain details of any hazardous hobbies or pastimes pursued or undertaken by insured persons. Obtain detailed 3 year loss history.

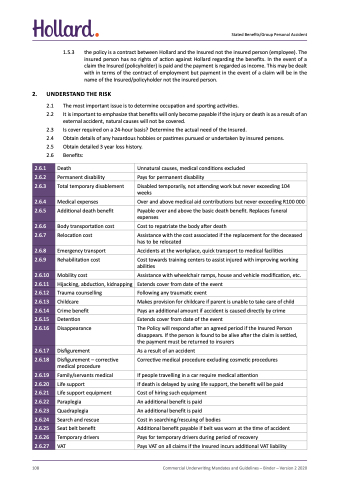

Benefits:

Stated Benefits/Group Personal Accident

2.

1.5.3 the policy is a contract between Hollard and the Insured not the insured person (employee). The insured person has no rights of action against Hollard regarding the benefits. In the event of a claim the Insured (policyholder) is paid and the payment is regarded as income. This may be dealt with in terms of the contract of employment but payment in the event of a claim will be in the name of the Insured/policyholder not the insured person.

UNDERSTAND THE RISK

2.6.1

2.6.2

2.6.3

2.6.4

2.6.5

2.6.6

2.6.7

2.6.8

2.6.9

2.6.10

2.6.11

2.6.12

2.6.13

2.6.14

2.6.15

2.6.16

2.6.17

2.6.18

2.6.19

2.6.20

2.6.21

2.6.22

2.6.23

2.6.24

2.6.25

2.6.26

2.6.27

Death

Permanent disability

Total temporary disablement

Medical expenses Additional death benefit

Body transportation cost Relocation cost

Emergency transport Rehabilitation cost

Mobility cost

Hijacking, abduction, kidnapping Trauma counselling

Childcare

Crime benefit

Detention

Disappearance

Disfigurement

Disfigurement – corrective medical procedure

Family/servants medical Life support

Life support equipment Paraplegia Quadraplegia

Search and rescue Seat belt benefit Temporary drivers VAT

Unnatural causes, medical conditions excluded Pays for permanent disability

Disabled temporarily, not attending work but never exceeding 104 weeks

Over and above medical aid contributions but never exceeding R100 000

Payable over and above the basic death benefit. Replaces funeral expenses

Cost to repatriate the body after death

Assistance with the cost associated if the replacement for the deceased has to be relocated

Accidents at the workplace, quick transport to medical facilities

Cost towards training centers to assist injured with improving working abilities

Assistance with wheelchair ramps, house and vehicle modification, etc. Extends cover from date of the event

Following any traumatic event

Makes provision for childcare if parent is unable to take care of child Pays an additional amount if accident is caused directly by crime Extends cover from date of the event

The Policy will respond after an agreed period if the Insured Person disappears. If the person is found to be alive after the claim is settled, the payment must be returned to insurers

As a result of an accident

Corrective medical procedure excluding cosmetic procedures

If people travelling in a car require medical attention

If death is delayed by using life support, the benefit will be paid Cost of hiring such equipment

An additional benefit is paid

An additional benefit is paid

Cost in searching/rescuing of bodies

Additional benefit payable if belt was worn at the time of accident Pays for temporary drivers during period of recovery

Pays VAT on all claims if the Insured incurs additional VAT liability

108

Commercial Underwriting Mandates and Guidelines – Binder – Version 2 2020