Page 63 - Policy Wording - Hollard Business Binder (2020-08-26)

P. 63

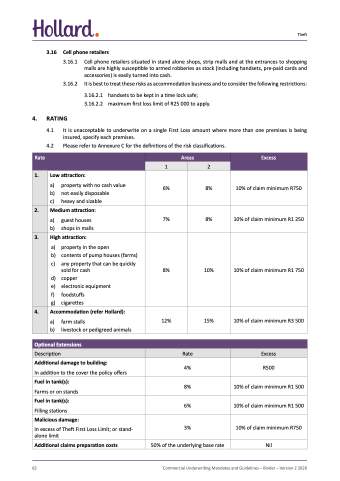

4.2 Please refer to Annexure C for the definitions of the risk classifications.

Theft

3.16 Cell phone retailers

3.16.1 Cell phone retailers situated in stand alone shops, strip malls and at the entrances to shopping malls are highly susceptible to armed robberies as stock (including handsets, pre-paid cards and accessories) is easily turned into cash.

3.16.2 It is best to treat these risks as accommodation business and to consider the following restrictions:

3.16.2.1 handsets to be kept in a time lock safe; 3.16.2.2 maximum first loss limit of R25 000 to apply.

4. RATING

4.1 It is unacceptable to underwrite on a single First Loss amount where more than one premises is being insured, specify each premises.

Rate

Areas

Excess

1

2

1.

Low attraction:

a) property with no cash value

b) not easily disposable

c) heavy and sizable

6%

8%

10% of claim minimum R750

2.

Medium attraction:

a) guest houses

b) shops in malls

7%

8%

10% of claim minimum R1 250

3.

High attraction:

a) property in the open

b) contents of pump houses (farms)

c) any property that can be quickly sold for cash

d) copper

e) electronic equipment

f) foodstuffs

g) cigarettes

8%

10%

10% of claim minimum R1 750

4.

Accommodation (refer Hollard):

a) farm stalls

b) livestock or pedigreed animals

12%

15%

10% of claim minimum R3 500

Optional Extensions

Description

Rate

Excess

Additional damage to building:

In addition to the cover the policy offers

Fuel in tank(s):

Farms or on stands

Fuel in tank(s):

Filling stations

Additional claims preparation costs

4%

8%

6%

50% of the underlying base rate

R500

10% of claim minimum R1 500

10% of claim minimum R1 500

Nil

Malicious damage:

In excess of Theft First Loss Limit; or stand- alone limit

3%

10% of claim minimum R750

62

Commercial Underwriting Mandates and Guidelines – Binder – Version 2 2020