Page 66 - Policy Wording - Hollard Business Binder (2020-08-26)

P. 66

Money

2.3 Money Collectors

2.3.1 Money in the care of collectors is seldom a good risk and should be limited very strictly as far as sum insured is concerned.

2.3.2 Suggest no more than R10 000 per event per collector or petrol attendant.

2.3.3 A drop safe is a must for this type of business. Garages usually do have drop safes and vehicles must be fitted with similar drop safes.

2.4 Personal accident

2.4.1 Cover is now automatically included up to the limits stated in the wording.

2.4.2 Increased limits may be purchased per employee.

3. UNDERWRITE THE RISK

3.1 Area

3.1.1 Consideration should be given to the area into which a risk falls when rating and accepting the risk.

3.1.2 The area in which the business operates and the area en route to the bank should also be considered.

3.2 Warranties

Money in transit endorsement automatically applies as stated in the wording.

3.3 Hold-up

Hold-ups are a reality and more often than not risks located in malls are being hit. Hold-ups are unexpected and malls are seen as a soft target. The location of the risk is important and should be considered carefully.

3.4 Seasonal increase

3.4.1 Cover is automatically included at 15% of the major limit (not exceeding R25 000) for the period 15 December to 15 January.

3.4.2 The option to provide increased limits or alternative periods of cover is available.

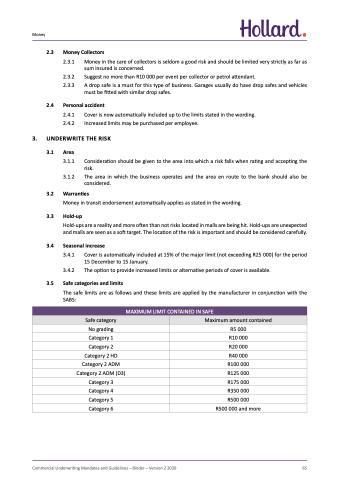

3.5 Safe categories and limits

The safe limits are as follows and these limits are applied by the manufacturer in conjunction with the SABS:

MAXIMUM LIMIT CONTAINED IN SAFE

Safe category

Maximum amount contained

No grading

R5 000

Category 1

R10 000

Category 2

R20 000

Category 2 HD

R40 000

Category 2 ADM

R100 000

Category 2 ADM (D3)

R125 000

Category 3

R175 000

Category 4

R350 000

Category 5

R500 000

Category 6

R500 000 and more

Commercial Underwriting Mandates and Guidelines – Binder – Version 2 2020 65