Page 75 - Policy Wording - Hollard Business Binder (2020-08-26)

P. 75

3.

UNDERWRITING THE RISK

3.1 Area

3.1.1 Consider the area into which goods are being transported. Do you have knowledge of the area? Do you understand the conditions, roads, crime, policing, etc.?

3.1.2 The type of goods (food transported under refrigerated conditions, distance to assistance, etc.) may impact on acceptance.

3.1.3 Be mindful of accepting risks in remote areas.

3.2 Premium calculation

3.2.1 It is unusual for any business not to know the amount representative of the annual carry. However, if the annual carry is not available, make sure the higher rate is applied to the load limit and that premium is charged per conveying vehicle.

3.2.2 If rating is based on load limit, ensure that you obtain the following:

3.2.2.1 number of vehicles in fleet;

3.2.2.2 highest value any one load;

3.2.2.3 number of loads per day.

3.2.3 More than one load limit or type of load can be accommodated; the Insured may have different load values and type of goods.

3.2.4 A declaration must be obtained at quoting stage as well as at each subsequent renewal and terms adjusted accordingly.

3.2.5 A minimum annual carry figure of R1 500 000 must be used when calculating premium.

4.

RATING

Please refer to Annexure C for the definitions of the risk classifications.

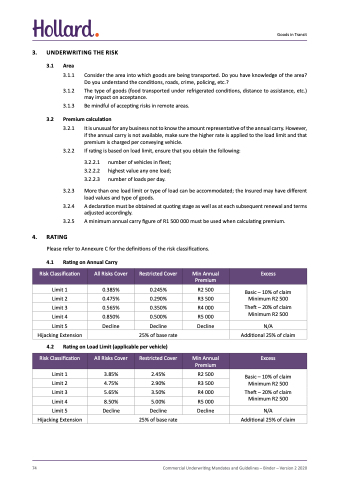

4.1 Rating on Annual Carry

Goods in Transit

Risk Classification

All Risks Cover

Restricted Cover

Min Annual Premium

Excess

Limit 1

Limit 2

Limit 3

Limit 4

Limit 5

Hijacking Extension

0.385% 0.245%

0.475% 0.290%

0.565% 0.350%

0.850% 0.500%

Decline Decline

25% of base

rate

R2 500

R3 500

R4 000

R5 000

Decline

R2 500

R3 500

R4 000

R5 000

Basic – 10% of claim Minimum R2 500

Theft – 20% of claim Minimum R2 500

N/A

Additional 25% of claim

Basic – 10% of claim Minimum R2 500

Theft – 20% of claim Minimum R2 500

N/A

Additional 25% of claim

4.2 Rating on Load Limit (applicable per vehicle)

Risk Classification

All Risks Cover

Restricted Cover

Min Annual Premium

Excess

Limit 1

Limit 2

Limit 3

Limit 4

Limit 5

Hijacking Extension

3.85% 2.45%

4.75% 2.90%

5.65% 3.50%

8.50% 5.00%

Decline Decline Decline

25% of base rate

74

Commercial Underwriting Mandates and Guidelines – Binder – Version 2 2020