Page 83 - Policy Wording - Hollard Business Binder (2020-08-26)

P. 83

1.

GENERAL

1.1 This section provides protection against legal liability attaching following injury, loss or damage to third parties or their property, which can result from many facets of the business.

1.2 Cover must only be written on a claims-made basis and is not available on a stand-alone basis.

1.3 Retroactive cover may be given only if cover has been in place with a previous insurer and has been uninterrupted.

1.4 This cover is not specialized and if the business insured involves specialized processes or exports then rather approach our specialist liability division for a quotation.

1.5 Due to the increased exposure with the wider cover, it is important to rate strictly according to the most hazardous activity.

1.6 Going forward, the policy wording only contains the Combined Liability wording.

1.7 This section shall only apply to policies issued in RSA.

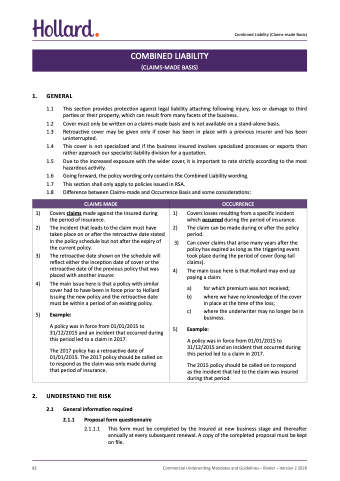

1.8 Difference between Claims-made and Occurrence Basis and some considerations:

2.

UNDERSTAND THE RISK

2.1

General information required

2.1.1

Proposal form questionnaire

2.1.1.1 This form must be completed by the Insured at new business stage and thereafter annually at every subsequent renewal. A copy of the completed proposal must be kept on file.

COMBINED LIABILITY (CLAIMS-MADE BASIS)

Combined Liability (Claims-made Basis)

CLAIMS MADE

OCCURRENCE

1) Covers claims made against the Insured during the period of insurance.

2) The incident that leads to the claim must have taken place on or after the retroactive date stated in the policy schedule but not after the expiry of the current policy.

3) The retroactive date shown on the schedule will reflect either the inception date of cover or the retroactive date of the previous policy that was placed with another insurer.

4) The main issue here is that a policy with similar cover had to have been in force prior to Hollard issuing the new policy and the retroactive date must be within a period of an existing policy.

5) Example:

A policy was in force from 01/01/2015 to 31/12/2015 and an incident that occurred during this period led to a claim in 2017.

The 2017 policy has a retroactive date of 01/01/2015. The 2017 policy should be called on to respond as the claim was only made during that period of insurance.

1) Covers losses resulting from a specific incident which occurred during the period of insurance.

2) The claim can be made during or after the policy period.

3) Can cover claims that arise many years after the policy has expired as long as the triggering event took place during the period of cover (long-tail claims).

4) The main issue here is that Hollard may end up

paying a claim:

a) for which premium was not received;

b) where we have no knowledge of the cover in place at the time of the loss;

c) where the underwriter may no longer be in business.

5) Example:

A policy was in force from 01/01/2015 to 31/12/2015 and an incident that occurred during this period led to a claim in 2017.

The 2015 policy should be called on to respond as the incident that led to the claim was insured during that period.

82

Commercial Underwriting Mandates and Guidelines – Binder – Version 2 2020