Page 43 - NEHA Annual Report 2023

P. 43

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2023

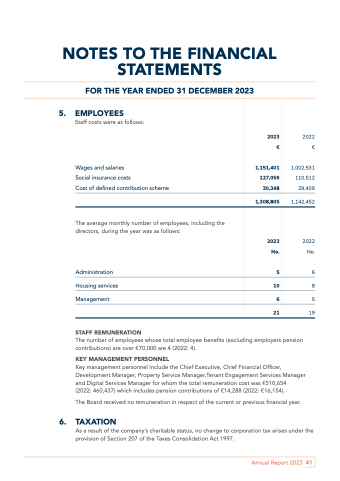

5. EMPLOYEES

Staff costs were as follows:

Wages and salaries

Social insurance costs

Cost of defined contribution scheme

The average monthly number of employees, including the directors, during the year was as follows:

Administration Housing services Management

STAFF REMUNERATION

2022 €

1,002,531 110,512 29,409

1,142,452

2022 No.

6 8 5

19

2023 €

1,151,401 127,056 30,348

1,308,805

2023 No.

5

10

6

21

The number of employees whose total employee benefits (excluding employers pension contributions) are over €70,000 are 4 (2022: 4).

KEY MANAGEMENT PERSONNEL

Key management personnel include the Chief Executive, Chief Financial Officer, Development Manager, Property Service Manager,Tenant Engagement Services Manager and Digital Services Manager for whom the total remuneration cost was €510,654

(2022: 460,437) which includes pension contributions of €14,288 (2022: €16,154).

The Board received no remuneration in respect of the current or previous financial year.

6. TAXATION

As a result of the company’s charitable status, no change to corporation tax arises under the provision of Section 207 of the Taxes Consolidation Act 1997.

Annual Report 2023 41