Page 6 - Demo

P. 6

HOW WILL THIS BENEFIT ME?

WE GROW TOGETHER & ELIMINATE RISKS!

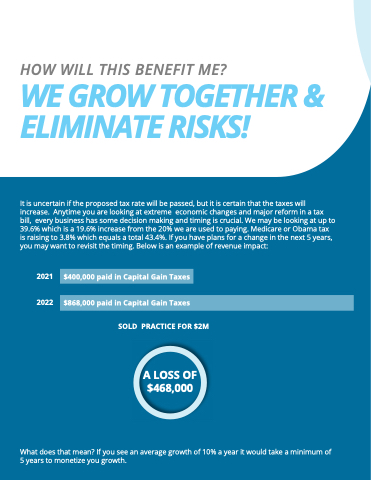

It is uncertain if the proposed tax rate will be passed, but it is certain that the taxes will increase. Anytime you are looking at extreme economic changes and major reform in a tax bill, every business has some decision making and timing is crucial. We may be looking at up to 39.6% which is a 19.6% increase from the 20% we are used to paying. Medicare or Obama tax is raising to 3.8% which equals a total 43.4%. If you have plans for a change in the next 5 years, you may want to revisit the timing. Below is an example of revenue impact:

2021 $400,000 paid in Capital Gain Taxes

2022 $868,000 paid in Capital Gain Taxes

SOLD PRACTICE FOR $2M

A LOSS OF $468,000

What does that mean? If you see an average growth of 10% a year it would take a minimum of 5 years to monetize you growth.