Page 19 - QuantScan-Example.pdf

P. 19

Professional investors only

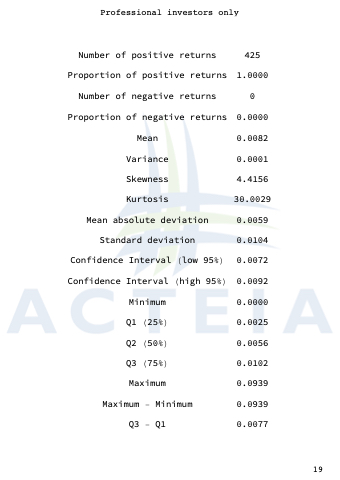

Number of positive returns Proportion of positive returns Number of negative returns Proportion of negative returns Mean

Variance

Skewness

Kurtosis

Mean absolute deviation Standard deviation Confidence Interval (low 95%) Confidence Interval (high 95%) Minimum

Q1 (25%)

Q2 (50%)

Q3 (75%)

Maximum

Maximum - Minimum

Q3 - Q1

425 1.0000 0 0.0000 0.0082 0.0001 4.4156 30.0029 0.0059 0.0104 0.0072 0.0092 0.0000 0.0025 0.0056 0.0102 0.0939 0.0939 0.0077

19