Page 24 - Quorum Training 2021

P. 24

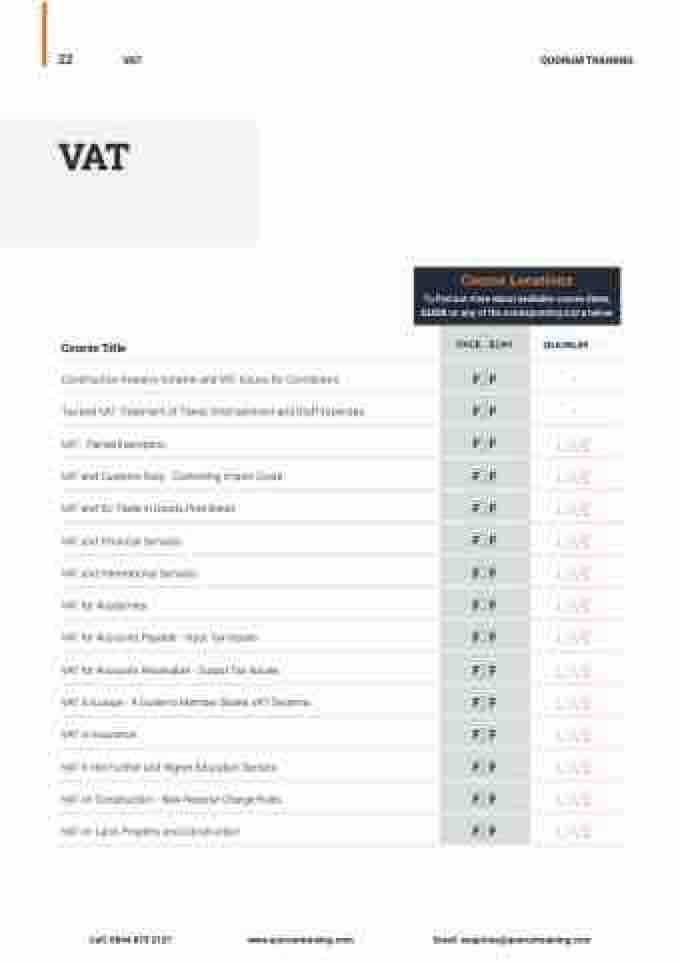

VAT

Course Locations

To find out more about available course dates, CLICK on any of the corresponding icons below

F2F

F2F

F2F

F2F

F2F

F2F

F2F

F2F

F2F

F2F

F2F

F2F

F2F

F2F

F2F

22 VAT

QUORUM TRAINING

Course Title

Construction Industry Scheme and VAT Issues for Contractors

Tax and VAT Treatment of Travel, Entertainment and Staff Expenses VAT - Partial Exemption

VAT and Customs Duty - Controlling Import Costs

VAT and EU Trade in Goods Post Brexit

VAT and Financial Services

VAT and International Services

VAT for Academies

VAT for Accounts Payable - Input Tax Issues

VAT for Accounts Receivable - Output Tax Issues

VAT in Europe - A Guide to Member States VAT Systems VAT in Insurance

VAT in the Further and Higher Education Sectors

VAT on Construction - New Reverse Charge Rules

VAT on Land, Property and Construction

– –

LIVE LIVE LIVE LIVE LIVE LIVE LIVE LIVE LIVE LIVE LIVE LIVE LIVE

Call: 0844 873 2121 www.quorumtraining.com

Email: enquiries@quorumtraining.com