Page 3 - 2024 Charitable Giving Guide

P. 3

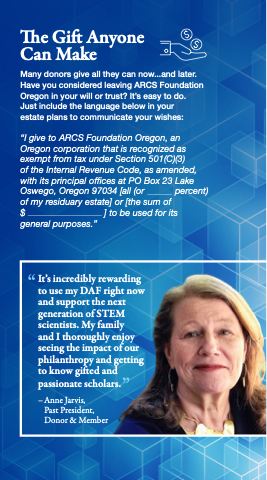

The Gift Anyone

Can Make

Many donors give all they can now...and later. Have you considered leaving ARCS Foundation Oregon in your will or trust? It’s easy to do. Just include the language below in your

estate plans to communicate your wishes:

“I give to ARCS Foundation Oregon, an Oregon corporation that is recognized as exempt from tax under Section 501(C)(3)

of the Internal Revenue Code, as amended, with its principal offices at PO Box 23 Lake Oswego, Oregon 97034 [all (or percent) of my residuary estate] or [the sum of

$ ] to be used for its general purposes.”

It’s incredibly rewarding to use my DAF right now and support the next generation of STEM scientists. My family

and I thoroughly enjoy seeing the impact of our philanthropy and getting to know gifted and

passionate scholars.

–Anne Jarvis,

Past President, Donor & Member