Page 50 - 2022 July Report

P. 50

July Report 2022

Investment Committee minutes (draft) (5)

rates and more restrictive fiscal policy. How much higher and restrictive is open to question. Wild cards such as the Ukraine war, COVID lockdowns in China and supply shortages triggered by deglobalization trends are further clouding the situation. The probability of a recession is growing and probably above 50%. The outlook for corporate earnings growth is also starting to deteriorate. However, a lot of this bad news is starting to get priced into shares. How much is unclear. In addition, some write downs in the Private Capital portfolio will have to be absorbed.

The Committee believes that the JSF portfolio is properly positioned for the current uncertain investing environment with a diversified portfolio and high-quality managers.

5. Chinese Exposure - Looking through its various emerging market manager portfolio (including Coronation) Prime estimates JSF’s total Chinese risk exposure constitutes about 33% of JSF’s Emerging Market investments and 2% of total JSF investments. Prime feels this is appropriate. Prime feels that equity prices may be bottoming out in China with the possibility of significant upside.

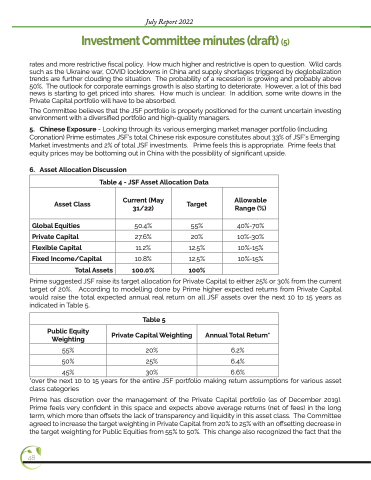

6. Asset Allocation Discussion

Table 4 - JSF Asset Allocation Data

Asset Class

Current (May 31/22)

Target

Allowable Range (%)

Global Equities

Private Capital

Flexible Capital

Fixed Income/Capital

Total Assets

50.4%

27.6%

11.2%

10.8%

55% 40%-70%

20% 10%-30%

12.5% 10%-15%

12.5% 10%-15%

100.0% 100%

Prime suggested JSF raise its target allocation for Private Capital to either 25% or 30% from the current target of 20%. According to modelling done by Prime higher expected returns from Private Capital would raise the total expected annual real return on all JSF assets over the next 10 to 15 years as indicated in Table 5.

Table 5

55% 20% 6.2%

50% 25% 6.4%

45% 30% 6.6%

*over the next 10 to 15 years for the entire JSF portfolio making return assumptions for various asset class categories

Prime has discretion over the management of the Private Capital portfolio (as of December 2019). Prime feels very confident in this space and expects above average returns (net of fees) in the long term, which more than offsets the lack of transparency and liquidity in this asset class. The Committee agreed to increase the target weighting in Private Capital from 20% to 25% with an offsetting decrease in the target weighting for Public Equities from 55% to 50%. This change also recognized the fact that the

Public Equity Weighting

Private Capital Weighting

Annual Total Return*

48