Page 8 - April JSF Report

P. 8

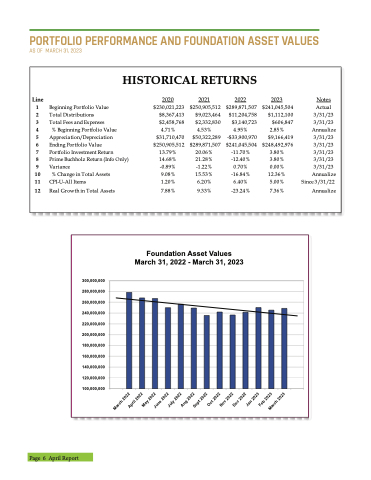

PORTFOLIO PERFORMANCE AND FOUNDATION ASSET VALUES

AS OF MARCH 31, 2023

Line

1 Beginning Portfolio Value

2 Total Distributions

3 Total Fees and Expenses

4 % Beginning Portfolio Value

5 Appreciation/Depreciation $31,710,470

6 Ending Portfolio Value

7 Portfolio Investment Return

8 Prime Buchholz Return (Info Only)

9 Variance

10 % Change in T otal Assets

11 CPI-U-All Items

12 Real Growth in T otal Assets

4.71%

$250,905,512 13.79% 14.68%

HISTORICAL RETURNS

2020 $230,021,223

2021 $250,905,512

$9,023,464 $2,332,830

4.53% $50,322,289

$289,871,507 20.06% 21.28%

2022 $289,871,507

$11,204,758 $3,140,723

4.95% -$33,900,970

$241,045,504 -11.70% -12.40%

2023 $241,045,504

$1,112,100 $606,847

2.85% $9,166,419

$248,492,976 3.80% 3.80%

Notes Actual 3/31/23 3/31/23 Annualize 3/31/23 3/31/23 3/31/23 3/31/23 3/31/23 Annualize

Since 3/31/22 Annualize

$8,367,413 $2,458,768

-0.89% -1.22% 0.70% 0.00%

9.08% 1.20% 7.88%

15.53% 6.20% 9.33%

-16.84% 6.40% -23.24%

12.36% 5.00% 7.36%

300,000,000 280,000,000 260,000,000 240,000,000 220,000,000 200,000,000 180,000,000 160,000,000 140,000,000 120,000,000 100,000,000

Foundation Asset Values March 31, 2022 - March 31, 2023

March 2022

April 2022

May 2022

June 2022

July 2022

Aug 2022

Sept 2022

Oct 2022

Nov 2022

Dec 2022

Jan 2023

Feb 2023

March 2023

Page 6 April Report