Page 11 - November report 2023

P. 11

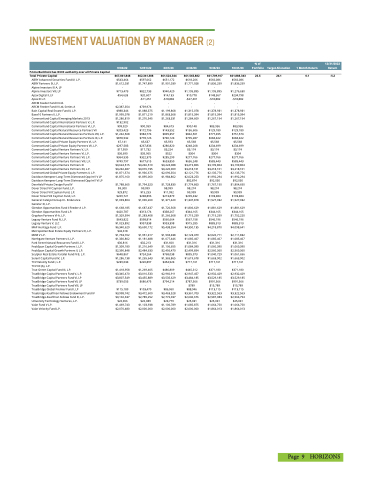

INVESTMENT VALUATION BY MANAGER (2)

% of 12/31/2022 9/30/22 12/31/22 3/31/23 6/30/23 9/30/23 10/31/23 Portfolio Target Allocation 1 Month Return Return

Prime Buchholz has OCIO authority over all Private Capital

Total Private Capital $67,861,848 $62,341,388 $61,524,344 $61,565,882 $61,709,107 $61,888,343 25.5 26.1 0.1 -5.2

ABRY Advanced Securities Fund IV, L.P. ABRY Partners IX, L.P.

Alpine Investors IX A, LP

Alpine Investors VIII, LP

Apax Digital II, LP

Apax XI L.P.

ARCM Feeder Fund III Ltd.

ARCM Feeder Fund IV Ltd, Series A

Bain Capital Real Estate Fund II, L.P.

Base10 Partners II, L.P.

Commonfund Capital Emerging Markets 2013 Commonfund Capital International Partners V, L.P. Commonfund Capital International Partners VI, L.P. Commonfund Capital Natural Resource Partners VII Commonfund Capital Natural Resources Partners VIII, L.P. Commonfund Capital Natural Resources Partners IX, L.P. Commonfund Capital Private Equity Partners VI, L.P. Commonfund Capital Private Equity Partners VII, L.P. Commonfund Capital Venture Partners V, L.P. Commonfund Capital Venture Partners VI, L.P. Commonfund Capital Venture Partners VII, L.P. Commonfund Capital Venture Partners VIII, L.P. Commonfund Capital Venture Partners XI

Commonfund Capital Venture Partners XII, L.P. Commonfund Global Private Equity Partners II, L.P. Davidson Kempner Long-Term Distressed Opp Int'l V LP Davidson Kempner Long-Term Distressed Opp Int'l VI LP Deerfield Private Design Fund IV

Dover Street VI Cayman Fund, L.P.

Dover Street VII Cayman Fund, L.P.

Dover Street VIII Cayman Fund, L.P.

General Catalyst Group XI - Endurance

Genstar XI, L.P.

Glendon Opportunities Fund II Feeder A L.P.

Glendon Opportunities Fund L.P.

Gryphon Partners VI-A, L.P.

Legacy Venture Fund IV, L.P.

Legacy Venture V, LLC

$543,464 $1,612,031 - $713,473 -$54,633 -

- $2,387,354 $988,346 $1,995,078 $1,286,819 $132,902 $99,929 $203,423 $1,242,568 $878,532 $7,141 $297,583 $17,959 $36,690 $364,535 $749,797 $3,624,515 $3,232,487 $1,871,574 $1,875,160 - $1,788,665 $9,300 $29,872 $269,721 $1,093,804 - $1,668,185 $420,787 $1,329,594 $643,822 $1,023,892

$597,062 $1,747,899 - $822,733 $20,607 -$11,251 - $739,974 $1,088,375 $1,871,219 $1,276,545 - $90,959 $172,796 $984,774 $778,126 $5,637 $267,836 $17,732 $35,965 $322,375 $677,615 $3,246,510 $3,076,735 $1,936,675 $1,895,060 - $1,794,323 $9,099 $15,253 $238,896 $1,096,260 - $1,687,437 $313,174 $1,283,408 $598,814 $957,838

$651,172 $1,901,039 - $940,420 $14,133 -$18,882 -

- $1,199,868 $1,863,368 $1,263,331 - $84,673 $143,552 $899,357 $730,123 $5,593 $280,820 $3,224 $522 $285,299 $653,850 $3,224,088 $3,220,009 $2,096,354 $1,984,802 - $1,728,830 $8,999 $11,992 $213,879 $1,371,420 - $1,720,568 $338,267 $1,266,368 $560,664 $953,398

$618,206 $1,771,928 - $1,195,895 $10,778 -$27,401 -

- $1,315,078 $1,815,394 $1,284,609 - $90,148 $136,606 $842,501 $705,287 $5,568 $248,208 $3,174 $304 $277,766 $636,248 $3,219,806 $3,218,101 $2,121,776 $2,023,253 $82,874 $1,774,863 $8,274 $9,999 $209,432 $1,347,818 - $1,806,629 $344,165 $1,715,259 $567,158 $915,285

$566,086 $1,836,259 - $1,195,895 $148,367 -$18,882 -

- $1,378,931 $1,815,394 $1,267,154 - $83,936 $129,180 $777,495 $684,322 $5,568 $234,699 $3,174 $304 $277,766 $585,443 $3,199,804 $3,218,101 $2,135,776 $1,992,294 $92,030 $1,767,150 $8,274 $9,999 $193,384 $1,527,032 - $1,881,629 $344,165 $1,715,259 $546,196 $885,313

$566,086 $1,836,259 - $1,276,630 $234,798 -$18,882 -

- $1,378,931 $1,815,394 $1,267,154 - $83,936 $129,180 $751,573 $684,322 $5,568 $234,699 $3,174 $304 $277,766 $585,443 $3,199,804 $3,218,101 $2,135,776 $1,992,294 $92,030 $1,804,650 $8,274 $9,999 $193,384 $1,527,032 - $1,881,629 $344,165 $1,752,220 $546,196 $885,313

MAP Heritage Fund L.P. $6,340,629 $5,690,172 $5,438,554 $4,350,135 $4,218,870 $4,098,641

Metropolitan Real Estate Equity Partners IV, L.P. MVM V L.P.

Northgate Venture Partners II, L.P.

Park Street Natural Resources Fund II, L.P. PeakSpan Capital Growth Partners I, L.P. PeakSpan Capital Growth Partners II, L.P. Sculptor Real Estate Parallel Fund IV B, L.P. Serent Capital Fund IV, L.P.

TCV Velocity Fund I, L.P.

TCV XII (A), L.P.

True Green Capital Fund III, L.P.

TrueBridge Capital Partners Fund V, L.P. TrueBridge Capital Partners Fund VI, LP TrueBridge Capital Partners Fund VII, LP TrueBridge Capital Partners Fund VIII, LP TrueBridge Global Premier Fund I, LP Truebridge-Kauffman Fellows Endowment Fund IV TrueBridge-Kauffman Fellows Fund III, L.P. University Technology Ventures, L.P.

Valar Fund V L.P.

Valar Velocity Fund L.P.

$42,618 $1,763,762 $1,330,802 $30,816 $1,309,180 $2,390,848 $648,867 $1,286,138 $239,033

- $1,418,958 $3,345,470 $3,807,549 $739,053 - $115,189 $3,998,742 $3,102,637 $26,966 $1,469,743 $2,070,480

- $1,951,317 $1,181,488 $32,213 $1,216,649 $2,484,633 $724,264 $1,265,643 $220,897 - $1,269,405 $3,010,533 $3,455,889 $686,475 - $103,470 $3,472,600 $2,789,252 $26,089 $1,103,938 $2,000,000

- $1,994,338 $1,077,446 $31,600 $1,106,655 $2,456,470 $768,038 $1,365,865 $454,523 - $486,809 $2,960,911 $3,535,629 $794,214 - $86,060 $3,463,528 $2,772,037 $23,779 $1,106,789 $2,000,000

- $2,123,379 $1,085,467 $31,316 $1,084,390 $2,499,854 $895,973 $1,619,678 $717,161 - $445,312 $2,947,457 $3,484,185 $787,566 $789 $88,946 $3,361,703 $2,636,676 $25,031 $1,085,875 $2,000,000

- $2,026,711 $1,085,467 $31,316 $1,060,390 $2,560,360 $1,040,729 $1,663,902 $717,161 - $371,180 $2,932,429 $3,529,185 $991,566 $15,789 $113,115 $3,322,563 $2,587,083 $25,031 $1,064,750 $1,864,013

- $2,111,832 $1,085,467 $31,316 $1,060,390 $2,560,360 $1,061,656 $1,663,902 $717,161 - $371,180 $2,932,429 $3,529,185 $991,566 $15,789 $113,115 $3,322,563 $2,564,794 $25,031 $1,064,750 $1,864,013

Page 9 HORIZONS