Page 28 - November report 2023

P. 28

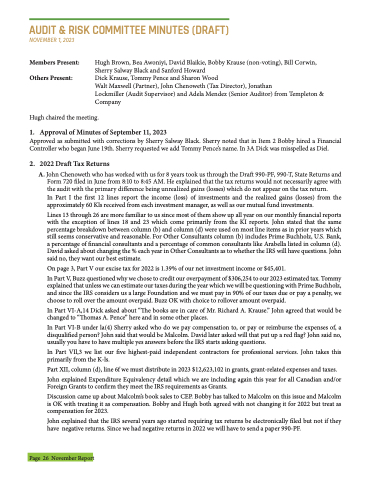

AUDIT & RISK COMMITTEE MINUTES (DRAFT)

NOVEMBER 1, 2023

Members Present: Others Present:

Hugh Brown, Bea Awoniyi, David Blaikie, Bobby Krause (non-voting), Bill Corwin, Sherry Salway Black and Sanford Howard

Dick Krause, Tommy Pence and Sharon Wood

Walt Maxwell (Partner), John Chenoweth (Tax Director), Jonathan

Lockmiller (Audit Supervisor) and Adela Mendez (Senior Auditor) from Templeton & Company

Hugh chaired the meeting.

1. Approval of Minutes of September 11, 2023

Approved as submitted with corrections by Sherry Salway Black. Sherry noted that in Item 2 Bobby hired a Financial Controller who began June 19th. Sherry requested we add Tommy Pence’s name. In 3A Dick was misspelled as Diel.

2. 2022 Draft Tax Returns

A. John Chenoweth who has worked with us for 8 years took us through the Draft 990-PF, 990-T, State Returns and Form 720 filed in June from 8:10 to 8:45 AM. He explained that the tax returns would not necessarily agree with the audit with the primary difference being unrealized gains (losses) which do not appear on the tax return.

In Part I the first 12 lines report the income (loss) of investments and the realized gains (losses) from the approximately 60 Kls received from each investment manager, as well as our mutual fund investments.

Lines 13 through 26 are more familiar to us since most of them show up all year on our monthly financial reports with the exception of lines 18 and 23 which come primarily from the KI reports. John stated that the same percentage breakdown between column (b) and column (d) were used on most line items as in prior years which still seems conservative and reasonable. For Other Consultants column (b) includes Prime Buchholz, U.S. Bank, a percentage of financial consultants and a percentage of common consultants like Arabella listed in column (d). David asked about changing the % each year in Other Consultants as to whether the IRS will have questions. John said no, they want our best estimate.

On page 3, Part V our excise tax for 2022 is 1.39% of our net investment income or $45,401.

In Part V, Buzz questioned why we chose to credit our overpayment of $306,254 to our 2023 estimated tax. Tommy explained that unless we can estimate our taxes during the year which we will be questioning with Prime Buchholz, and since the IRS considers us a large Foundation and we must pay in 90% of our taxes due or pay a penalty, we choose to roll over the amount overpaid. Buzz OK with choice to rollover amount overpaid.

In Part VI-A,14 Dick asked about “The books are in care of Mr. Richard A. Krause.” John agreed that would be changed to “Thomas A. Pence” here and in some other places.

In Part VI-B under la(4) Sherry asked who do we pay compensation to, or pay or reimburse the expenses of, a disqualified person? John said that would be Malcolm. David later asked will that put up a red flag? John said no, usually you have to have multiple yes answers before the IRS starts asking questions.

In Part VIl,3 we list our five highest-paid independent contractors for professional services. John takes this primarily from the K-ls.

Part XII, column (d), line 6f we must distribute in 2023 $12,623,102 in grants, grant-related expenses and taxes.

John explained Expenditure Equivalency detail which we are including again this year for all Canadian and/or Foreign Grants to confirm they meet the IRS requirements as Grants.

Discussion came up about Malcolm’s book sales to CEP. Bobby has talked to Malcolm on this issue and Malcolm is OK with treating it as compensation. Bobby and Hugh both agreed with not changing it for 2022 but treat as compensation for 2023.

John explained that the IRS several years ago started requiring tax returns be electronically filed but not if they have negative returns. Since we had negative returns in 2022 we will have to send a paper 990-PF.

Page 26 November Report