Page 31 - November report 2023

P. 31

AUDIT & RISK COMMITTEE MINUTES (DRAFT) (4)

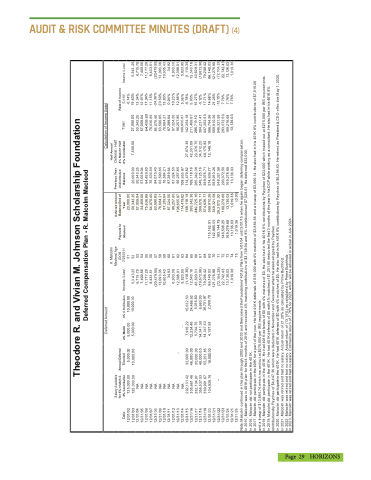

Theodore R. and Vivian M. Johnson Scholarship Foundation Deferred Compensation Plan - R. Malcolm Macleod

Deferred Amount

Calculation of Income (loss) R. Malcolm

Half Annual Salary Available

Macleod Age

Deferred Amount Previous Year Deferral + Half for 4% rv\atch &

Annual Deferral

(DOB

Payouts to Balance End of Undistributed 4% Match+ Half Rate of Income Date

8% Conlribution

Elected

4% Match

6% C.Onlribution

Income /Loss\

7/261511

Macleod Year Balance 8% Contribution Tolal /Loss\ Income /Loss\ 12/31/02

125,000.00

5,000.00

5,000.00

10 ,000.00

51

20,000.00 -0.74% 12/31/03

125,000.00

10,000.00

5,000.00

10,000 .00

5,3 4 3.25

52

50.343.25 20,000.00 7,500.00 27,500.00 19.43% 5,343 .25 12/31/04

NA

6,715.79

53

57,059.04 50,343.25 50,343.25 13.34% 6,715.79 12/31/05

NA

7,400.56

54

64,459.60 57,059.04 57,059.04 12.97% 7,400.56 12/31/06

NA

11,177.29

55

75,636.89 64,459.60 64,459.60 17.34% 11,177.29 12/31/07

NA

8,433.51

56

64,070.40 75,636.89 75,636.89 11.15% 8,433.51 12/31/06

NA

(20,479.55)

57

63,590.85 84,070.40 84,070.40 -24.36% (20,479.55) 12/31/09

NA

13,093.36

58

76,684.21 63,590.85 63,590.85 20.59% 13,093.36 12/31/10

NA

10,605.43

59

87,289.64 76,684.21 76,684.21 13.83% 10,605.43 12/31/11

NA

34.92

60

87,324.55 87,289.64 87,289.64 0.04% 34.92 12/31/12

NA

6,933.30

61

96,257.65 87,324.55 87,324.55 10.23% 8,933.30 12/31/13

NA

-

12,398.01

62

108,655.87 96,257.85 96,257.85 12.88% 12,398.01 12/31/14

NA

-

5,823.95

63

114,479.82 108,655.87 108,655.87 5.36% 5,823.95 12/31/15

292,131.42

32,000.00

7,916.22

15,632.50

(1,110.36)

64

169,118.18 114,479.82 27,674.36 142,354.18 -0.78% (1,110.36) 12/31/16

305,661.46

46,000.00

12,234.46

24,466.92

12,540.16

65

265,342.36 169,118.18 42,351.69 211,469.87 5.93% 12,540.16 12/31/17

332,734.97

30,000.00

5,734.70

5,016.80

43,629.31

66

349,725.16 265,342.36 20,376.75 285,719.10 15.27% 43,629.31 12/31/16

356,537.53

48,000.00

14,341.50

6,663.00

(19,672.96)

67

399,076.71 349,725.16 34,512.25 384,237.41 -5.12% (19,672.96) 12/31/19

369,991.67

55,251.85

14,347.62

26,751.97

79,208.42

68

574,636.77 399,076.71 48,175.82 447,252.53 17.71% 79,208.42 12/31/20 104,939.76 16,000.00 4,197.59 2,098.78

86,140.03 69

115,162.91 569.910.26 574,636.77 12,148.19 586,784.96 14.68% 86,140.03 12/31/21

121,276.90

70

142,865.59 548,321.58 569,910.26 569,910.26 21.26% 121,276.90 12/31/22

- (72,104.29)

71

183,144.79 29,3 072 .50 548,321.58 546,321.58 -13.15% (72,104.29) 12/31/23

22,742.43

72

146,536.25 169,278.68 293,072.50 293,072.50 7.76% 22,742.43 12/31/24

13,136.03

73

169,278.68 13,136.03 169,278.68 169,276.68 7.76% 13,136.03 12/31/25

1,019.36

74

13,136.03 1,019.36 13,136.03 13,136.03 7.76% 1,019.36 12/31/26

75

1,019.36 (0.00) Note: Malcolm continued in this plan lhrough 2002 and 2003 and then joined the Foundations' 401(k) Plan from 1/01/04 until 5/01/15 when he again began deferring compensation. In 2015, Malcolm was in 401K plan for first 4 months of 2015 and received 4% matching contributions of $3,769.04 and 8% contributionsof $7,538.01. He deferred $32,000.

In 2016, Malcolm did not participate in the 401K.

In 2017, Malcolm did participate in the 401K for a part of the year. He had 401K deferrals of S18,000 with 4% matches of $3,884.56 and a trueup of $3,690.14. He also had in his 401K 8% contributions of $7,915.26 and a trueup of $13,684.74 which ma xed out at $270,000 per IRS requirements.

In 2018, Malcolm did participate in the 401K. He had 401K deferrals of $0 with 4% matches of $0. He also had in his 401K 8% contributions by Paychex of $22,000 which maxed out at $275,000 per IRS requirements. In 2019, Malcolm did participate in the 401K. He had 401K deferrals of $0 with 4% matches of $1,251.85 deduc ted the first 3 months of the year in his DCP while working as a consulta nt. He also had in his 401K 8% contributionsby Paychex of $4,447.36 which were deducted in November and December when he was being paid by Paychex.

In 2020, Malcolm did participate in the 401K. He had 401K deferrals of $0 with 4% matches of $0. He also had in his 401K 8% contributions by Paychex of $6,296.40. He retired as President & CEO effec tive May 1, 2020. In 2021, Malcolm was retired and had no salary. Actual return of 21.28% as calculated by Prime Buchholz.

In 2022, Malcolm was retired and had no salary. Actual return of (13.15%) as calculated by Prime Buchholz .

In 2023, Malcolm was retired and had no salarv. Estimatina return of 7.76% for 2023, which will be adiusted lo actual in Julv 2024.

Page 29 HORIZONS