Page 12 - 2022 August Report

P. 12

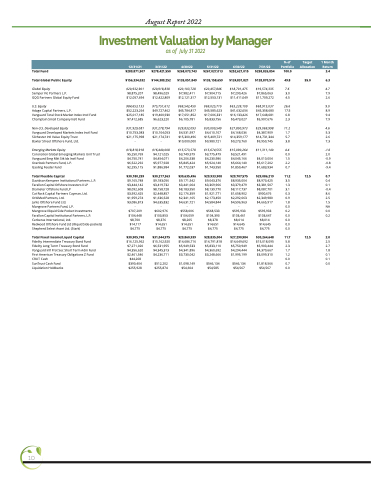

August Report 2022

Investment Valuation by Manager

asof July312022

Total Fund

Total Global Public Equity

Global Equity

Semper Vic Partners L.P.

GQG Partners Global Equity Fund

U.S. Equity

Adage Capital Partners, L.P.

Vanguard Total Stock Market Index Instl Fund Champlain Small Company Instl Fund

Non-U.S. Developed Equity

Vanguard Developed Markets Index Instl Fund Silchester Intl Value Equity Trust

Baxter Street Offshore Fund, Ltd.

Emerging Markets Equity

Coronation Global Emerging Markets Unit Trust Vanguard Emg Mkt Stk Idx Instl Fund

Overlook Partners Fund, L.P.

Gaoling Feeder Fund

Total Flexible Capital

Davidson Kempner Institutional Partners, L.P. Farallon Capital Offshore Investors II LP Diameter Offshore Fund LP

Cat Rock Capital Partners Cayman, Ltd. OrbiMed Partners, Ltd.

Junto Offshore Fund Ltd.

Mangrove Partners Fund, L.P.

Mangrove Illiquid Side Pocket Investments Farallon Capital Institutional Partners, L.P. Cerberus International, Ltd.

Redwood Offshore Fund Ltd (Illiquid Side-pockets) Shepherd Select Asset Ltd. (Stark)

Total Fixed Income/Liquid Capital

Fidelity Intermediate Treasury Bond Fund Fidelity Long Term Treasury Bond Fund Vanguard Infl Prot Sec Short Term Adm Fund First American Treasury Obligations Z Fund CRUT Cash

SunTrust Cash Fund LiquidationHoldbacks

$289,871,507

$156,334,032

$20,932,901

$8,875,207 $12,057,694

$84,653,133

$52,223,264 $25,017,185 $7,412,685

$31,929,081

$10,753,083 $21,175,998 -

$18,818,918

$5,250,769 $4,750,741 $6,522,292 $2,295,115

$30,180,259

$9,165,748 $3,444,142 $8,092,608 $3,592,425 $1,959,274 $3,086,813 -

$707,209 $104,448 $8,700 $14,117 $4,775

$30,905,748

$278,421,550

$144,389,252

$20,918,838

$8,496,029 $12,422,809

$75,751,612

$49,727,462 $19,400,930 $6,623,220

$31,278,794

$10,104,053 $21,174,741 -

$16,440,008

$4,121,025 $4,454,071 $5,977,928 $1,886,984

$30,217,363

$9,183,056 $3,419,732 $8,158,728 $2,448,857 $1,636,528 $4,635,832 -

$602,976 $103,853 $8,376 $14,651 $4,775

$31,044,975

$268,073,743

$135,051,849

$20,103,728

$7,982,411 $12,121,317

$69,542,450

$45,784,817 $17,651,852 $6,105,781

$29,832,093

$4,531,597 $15,300,496 $10,000,000

$15,573,578

$3,749,579 $4,206,538 $5,845,424 $1,772,037

$30,635,496

$9,171,542 $3,441,064 $8,183,950 $2,176,359 $2,341,165 $4,631,721 -

$558,006 $104,059 $8,205 $14,651 $4,775

$29,860,939

$267,027,013

$135,158,659

$20,457,846

$7,904,715 $12,553,131

$69,025,710

$45,585,623 $17,606,331 $5,833,756

$30,000,549

$4,610,107 $15,409,721 $9,980,721

$15,674,555

$3,775,479 $4,230,986 $5,924,140 $1,743,950

$29,933,908

$9,043,376 $3,369,966 $8,139,770 $1,921,771 $2,173,450 $4,584,844 -

$568,533 $104,393 $8,378 $14,651 $4,775

$28,835,004

$252,621,015

$124,831,821

$18,701,475

$7,290,426 $11,411,049

$63,239,109

$41,632,656 $16,133,426 $5,473,027

$27,800,973

$4,168,036 $14,359,177 $9,273,760

$15,090,264

$3,521,491 $4,045,166 $5,664,140 $1,859,467

$29,707,575

$8,935,004 $3,379,479 $8,117,737 $1,658,902 $2,292,663 $4,596,963 -

$595,933 $103,461 $8,014 $14,645 $4,775

$27,290,984

$258,826,854 100.0

$128,870,510 49.8

$19,574,335 7.6

$7,865,063 3.0 $11,709,272 4.5

$68,915,037 26.6

$45,358,680 17.5 $17,648,681 6.8 $5,907,676 2.3

$29,069,998 11.2

$4,387,909 1.7 $14,731,344 5.7 $9,950,745 3.8

$11,311,140 4.4

- 0.0 $4,010,004 1.5 $5,617,202 2.2 $1,683,934 0.7

$29,086,219 11.2

$8,973,425 3.5 $3,381,507 1.3 $8,087,701 3.1

$900,676 0.3 $2,349,980 0.9 $4,665,917 1.8

- 0.0 $595,933 0.2 $103,647 0.0

$8,014 0.0 $14,645 0.0 $4,775 0.0

$30,264,648 11.7

$15,018,095 5.8 $5,903,444 2.3 $4,370,667 1.7 $3,099,310 1.2

- 0.0 $1,818,566 0.7 $255,928 $255,874 $54,604 $54,585 $54,567 $54,567 0.0

3.4

55.0 6.3

4.7

7.9 2.6

9.0

8.9 9.4 7.9

4.6

5.3 2.6 7.3

-1.6

2.0 -0.9 -0.8 -9.4

12.5 0.7

0.4 0.1 -0.4 8.6 2.5 1.5 NA 0.0 0.2

12.5 2.0

2.5 2.7 1.8 0.1 0.1 0.0

$16,125,962 $7,271,020 $4,356,620 $2,461,546 $44,268 $390,404

$15,162,920 $6,531,955 $4,345,313 $4,236,711 -

$14,686,716 $5,949,533 $4,341,896 $3,730,042 - $1,098,149

$14,791,818 $5,833,110 $4,360,692 $3,248,666 -

$14,649,692 $5,750,949 $4,294,444 $1,995,199 -

$512,202

$546,134

$546,134

% of Target 1 Month 12/31/21 3/31/22 4/30/22 5/31/22 6/30/22 7/31/22 Portfolio Allocation Return

10