Page 9 - January Report 2025

P. 9

Education / A Powerful force for change Page 7

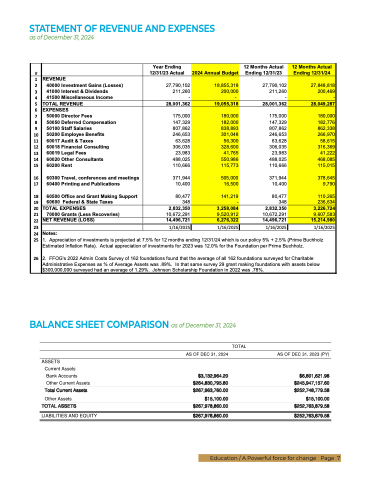

BALANCE SHEET COMPARISON as of December 31, 2024

STATEMENT OF REVENUE AND EXPENSES

as of December 31, 2024

#

Year Ending

12/31/23 Actual 2024 Annual Budget

12 Months Actual

Ending 12/31/23

12 Months Actual

Ending 12/31/24

1 REVENUE

2 40000 Investment Gains (Losses) 27,790,102 18,855,318 27,790,102 27,848,818

3 41000 Interest & Dividends 211,260 200,000 211,260 200,469

4 41500 Miscellaneous Income - - - -

5 TOTAL REVENUE 28,001,362 19,055,318 28,001,362 28,049,287

6 EXPENSES

7 50000 Director Fees 175,000 180,000 175,000 180,000

8 50050 Deferred Compensation 147,329 182,000 147,329 182,776

9 50100 Staff Salaries 807,862 838,893 807,862 862,338

10 50200 Employee Benefits 246,653 301,048 246,653 266,970

11 60017 Audit & Taxes 63,628 56,300 63,628 58,615

12 60018 Financial Consulting 306,035 328,600 306,035 316,369

13 60019 Legal Fees 23,983 41,765 23,983 41,222

14 60020 Other Consultants 488,025 550,986 488,025 468,085

15 60200 Rent 110,666 115,773 110,666 115,015

16 60300 Travel, conferences and meetings 371,944 505,000 371,944 378,645

17 60400 Printing and Publications 10,400 16,500 10,400 9,790

18 60500 Office and Grant Making Support 80,477 141,219 80,477 110,265

19 60600 Federal & State Taxes 348 - 348 236,634

20 TOTAL EXPENSES 2,832,350 3,258,084 2,832,350 3,226,724

21 70000 Grants (Less Recoveries) 10,672,291 9,520,912 10,672,291 9,607,583

22 NET REVENUE (LOSS) 14,496,721 6,276,322 14,496,721 15,214,980

23 1/16/2025 1/16/2025 1/16/2025 1/16/2025

24

25

26 2. FFOG's 2022 Admin Costs Survey of 162 foundations found that the average of all 162 foundations surveyed for Charitable

Administrative Expenses as % of Average Assets was .89%. In that same survey 29 grant making foundations with assets below

$300,000,000 surveyed had an average of 1.29%. Johnson Scholarship Foundation in 2022 was .78%.

Notes:

Theodore R. & Vivian M. Johnson Scholarship Foundation, Inc.

Statement of Revenue & Expenses

Twelve Months Ending December 31, 2024

1. Appreciation of investments is projected at 7.5% for 12 months ending 12/31/24 which is our policy 5% + 2.5% (Prime Buchholz

Estimated Inflation Rate). Actual appreciation of investments for 2023 was 12.0% for the Foundation per Prime Buchholz.