Page 32 - Raco 2017

P. 32

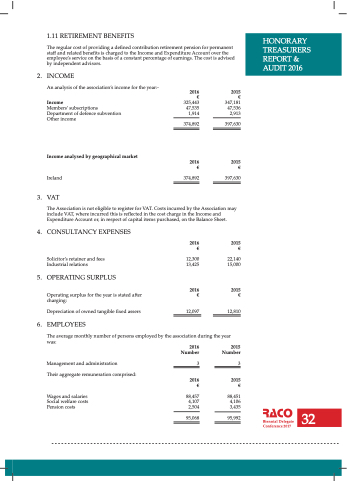

1.11 RETIREMENT BENEFITS

The regular cost of providing a defined contribution retirement pension for permanent staff and related benefits is charged to the Income and Expenditure Account over the employee’s service on the basis of a constant percentage of earnings. The cost is advised by independent advisors.

2. INCOME

An analysis of the association’s income for the year:-

2015€

347,181 47,536 2,913

397,630

2015€

397,630

2016€ Income 325,443

Members’ subscriptions Department of defence subvention Other income

Income analysed by geographical market

47,535 1,914

374,892

2016€

Ireland 374,892

3. VAT

The Association is not eligible to register for VAT. Costs incurred by the Association may include VAT, where incurred this is reflected in the cost charge in the Income and Expenditure Account or, in respect of capital items purchased, on the Balance Sheet.

4. CONSULTANCY EXPENSES

Solicitor’s retainer and fees Industrial relations

5. OPERATING SURPLUS

Operating surplus for the year is stated after charging:

Management and administration

Their aggregate remuneration comprised:

Wages and salaries Social welfare costs Pension costs

2016€

12,300 13,425

2016€

12,097

The average monthly number of persons employed by the association during the year

Depreciation of owned tangible fixed assers

2015€

22,140 15,000

2015€

12,810

2015 Number

3

2015€

88,451 4,106 3,435

95,992

HONORARY TREASURERS REPORT & AUDIT 2016

6. EMPLOYEES was:

2016 Number

3

2016€

88,457 4,107 2,504

95,068

Biennial Delegate Conference 2017

3322