Page 20 - CAO Annual Report 2024/2025

P. 20

CENTRAL APPLICATIONS OFFICE

CENTRAL APPLICATIONS OFFICE NPC (RF) REGISTRATION NUMBER: 2007/002819/08

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

FOR THE YEAR ENDED 28 FEBRUARY 2025 (Continued)

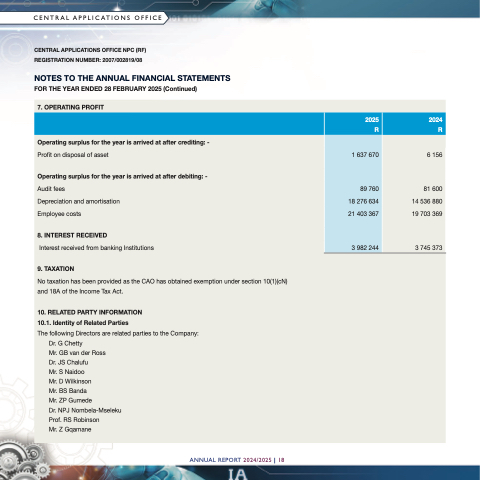

7. OPERATING PROFIT

2025 2024 RR

Operating surplus for the year is arrived at after crediting: -

Profit on disposal of asset

1 637 670 6 156

Operating surplus for the year is arrived at after debiting: -

Audit fees

89 760 81 600

Depreciation and amortisation

18 276 634 14 536 880

Employee costs

21 403 367 19 703 369

8. INTEREST RECEIVED

Interest received from banking Institutions

3 982 244 3 745 373

9. TAXATION

No taxation has been provided as the CAO has obtained exemption under section 10(1)(cN) and 18A of the Income Tax Act.

10. RELATED PARTY INFORMATION

10.1. Identity of Related Parties

The following Directors are related parties to the Company:

Dr. G Chetty

Mr. GB van der Ross

Dr. JS Chalufu

Mr. S Naidoo

Mr. D Wilkinson

Mr. BS Banda

Mr. ZP Gumede

Dr. NPJ Nombela-Mseleku

Prof. RS Robinson

Mr. Z Gqamane

ANNUAL REPORT 2024/2025 | 18