Page 7 - 2018 Emerging Business Performance Report

P. 7

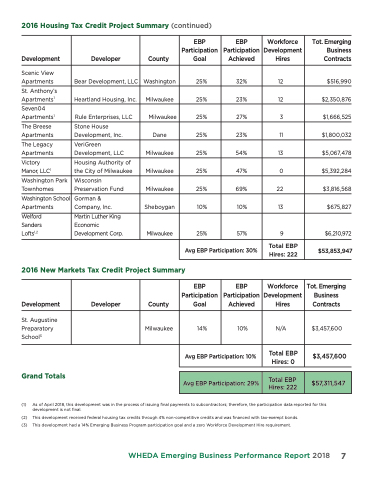

2016 Housing Tax Credit Project Summary (continued) Development

Scenic View Apartments

St. Anthony’s Apartments1 Seven04 Apartments1

The Breese Apartments

The Legacy Apartments Victory

Manor, LLC1 Washington Park Townhomes Washington School Apartments Welford

Sanders Lofts1,2

2016 New Markets Tax Credit Project Summary

Development

St. Augustine Preparatory School3

Grand Totals

Tot. Emerging Business Contracts

$516,990 $2,350,876 $1,666,525 $1,800,032 $5,067,478 $5,392,284 $3,816,568 $675,827

$6,210,972

$53,853,947

Tot. Emerging Business Contracts

$3,457,600

$3,457,600

Developer

Bear Development, LLC

Heartland Housing, Inc.

Rule Enterprises, LLC

Stone House Development, Inc.

VeriGreen Development, LLC

Housing Authority of the City of Milwaukee

Wisconsin Preservation Fund

Gorman & Company, Inc.

Martin Luther King Economic Development Corp.

County

Washington

Milwaukee

Milwaukee

Dane

Milwaukee

Milwaukee

Milwaukee

Sheboygan

Milwaukee

EBP Participation Goal

25%

25%

25%

25%

25%

25%

25%

10%

25%

Avg EBP Participation: 30%

EBP Participation Achieved

32%

23%

27%

23%

54%

47%

69%

10%

57%

Workforce Development Hires

12

12

3

11

13

0

22

13

9

Total EBP Hires: 222

Developer

County

Milwaukee

EBP Participation Goal

14%

Avg EBP Participation: 10%

EBP Participation Achieved

10%

Workforce Development Hires

N/A

Total EBP Hires: 0

Avg EBP Participation: 29%

Total EBP Hires: 222

$57,311,547

(1) As of April 2018, this development was in the process of issuing final payments to subcontractors; therefore, the participation data reported for this development is not final.

(2) This development received federal housing tax credits through 4% non-competitive credits and was financed with tax-exempt bonds.

(3) This development had a 14% Emerging Business Program participation goal and a zero Workforce Development Hire requirement.

WHEDA Emerging Business Performance Report 2018 7