Page 6 - 906 E. Main St

P. 6

Why lease when you can own?

Property Address: 906 E. Main St. El Cajon

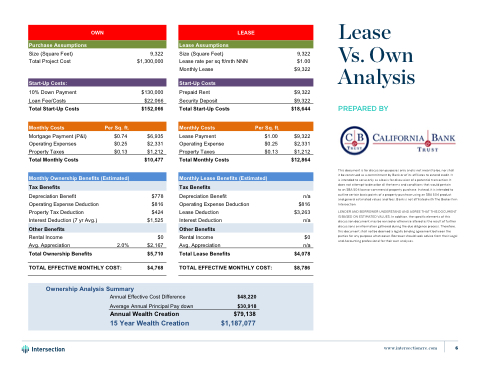

Lease Vs. Own Analysis

OWN

Purchase Assumptions

LEASE

Lease Assumptions

Size (Square Feet) Total Project Cost

Start-Up Costs:

10% Down Payment Loan Fee/Costs Total Start-Up Costs

Monthly Costs

Mortgage Payment (P&I) Operating Expenses Property Taxes

Total Monthly Costs

Depreciation Benefit Operating Expense Deduction Property Tax Deduction Interest Deduction (7 yr Avg.) Other Benefits

Rental Income

Avg. Appreciation

Total Ownership Benefits

9,322 $1,300,000

$130,000 $22,066 $152,066

$6,935 $2,331 $1,212

$10,477

$778

$816

$424

$1,525

$0 $2,167 $5,710

$4,768

Size (Square Feet)

Lease rate per sq ft/mth NNN Monthly Lease

Start-Up Costs

Prepaid Rent Security Deposit Total Start-Up Costs

Monthly Costs

Lease Payment Operating Expense Property Taxes

Total Monthly Costs

Depreciation Benefit Operating Expense Deduction Lease Deduction

Interest Deduction

Other Benefits

Rental Income

Avg. Appreciation

Total Lease Benefits

9,322

$1.00 $9,322

$9,322

$9,322

TOTAL EFFECTIVE MONTHLY COST:

TOTAL EFFECTIVE MONTHLY COST:

Per Sq. ft.

$0.74 $0.25 $0.13

Per Sq. ft.

$18,644 PREPARED BY $9,322

2.0%

$0 n/a $4,078

$8,786

this document shall not be deemed a legally binding agreement between the parties for any purpose whatsoever. Borrower should seek advice from their Legal and Accounting professional for their own analyses.

$1.00 $0.25 $0.13

$2,331

$1,212

$12,864

$3,263

LENDER AND BORROWER UNDERSTAND AND AGREE THAT THIS DOCUMENT

This document is for discussion purposes only and is not meant to be, nor shall

it be construed as a commitment by Bank or of its affiliates to extend credit. It

is intended to serve only as a basis for discussion of a potential transaction. It does not attempt to describe all the terms and conditions that would pertain

to an SBA 504 loan or commercial property purchase. Instead, it is intended to outline certain basic points of a property purchase using an SBA 504 product and general estimated values and fees. Bank is not affiliated with The Broker firm

Monthly Ownership Benefits (Estimated)

Tax Benefits

Monthly Lease Benefits (Estimated)

Tax Benefits

n/a

$816 Intersection.

IS BASED ON ESTIMATED VALUES. In addition, the specific elements of this n/a discussion document may be revised or otherwise altered as the result of further discussions or information gathered during the due diligence process. Therefore,

Ownership Analysis Summary

Annual Effective Cost Difference Average Annual Principal Pay down

Annual Wealth Creation

15 Year Wealth Creation

$48,220

$30,918 $79,138

$1,187,077

Long Term Fixed Rates

Quick Response (48 Hour Pre-Qualification Available)

Prepared exclusively for:

Intersection Kyle Clark

www.intersectioncre.com 6

For more information contact :

California Bank & Trust Ray Weamer