Page 15 - Bahamas Waste inside pages

P. 15

NOTES TO FINANCIAL STATEMENTS

(Expressed in Bahamian Dollars)

December 31, 2018

2. BASIS OF pREpARATION (CONTINuED)

IFRS 9 Financial Instruments

IFRS 9 replaces IAS 39, Financial Instruments: Recognition and Measurement for annual periods beginning on or after January 1, 2018, bringing together all three aspects of the accounting for financial instruments: classification and measurement; impairment; and hedge accounting. The Company applied IFRS 9 using the modified retrospective approach, with an initial application date of January 1, 2018. The Company has not restated the comparative information, which continues to be reported under IAS 39.

Classification and measurement of financial assets and financial liabilities

The Company has not designated any financial liabilities as at fair value through profit or loss. There are no changes in classification and measurement for the Company’s financial liabilities.

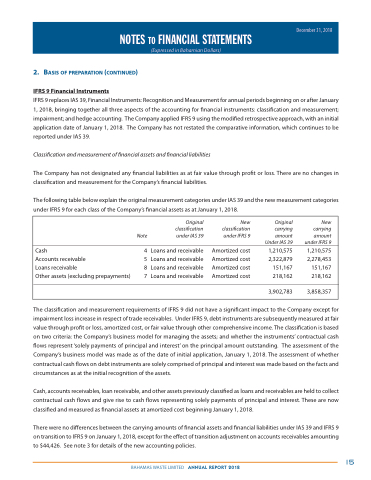

The following table below explain the original measurement categories under IAS 39 and the new measurement categories under IFRS 9 for each class of the Company’s financial assets as at January 1, 2018.

Original classification Note under IAS 39

New classification under IFRS 9

Original carrying amount

Under IAS 39

New carrying amount under IFRS 9

Cash

Accounts receivable

Loans receivable

Other assets (excluding prepayments)

4 Loans and receivable 5 Loans and receivable 8 Loans and receivable 7 Loans and receivable

Amortized cost Amortized cost Amortized cost Amortized cost

1,210,575 2,322,879 151,167 218,162

1,210,575 2,278,453 151,167 218,162

3,902,783 3,858,357

The classification and measurement requirements of IFRS 9 did not have a significant impact to the Company except for impairment loss increase in respect of trade receivables. Under IFRS 9, debt instruments are subsequently measured at fair value through profit or loss, amortized cost, or fair value through other comprehensive income. The classification is based on two criteria: the Company’s business model for managing the assets; and whether the instruments’ contractual cash flows represent ‘solely payments of principal and interest’ on the principal amount outstanding. The assessment of the Company’s business model was made as of the date of initial application, January 1, 2018. The assessment of whether contractual cash flows on debt instruments are solely comprised of principal and interest was made based on the facts and circumstances as at the initial recognition of the assets.

Cash, accounts receivables, loan receivable, and other assets previously classified as loans and receivables are held to collect contractual cash flows and give rise to cash flows representing solely payments of principal and interest. These are now classified and measured as financial assets at amortized cost beginning January 1, 2018.

There were no differences between the carrying amounts of financial assets and financial liabilities under IAS 39 and IFRS 9 on transition to IFRS 9 on January 1, 2018, except for the effect of transition adjustment on accounts receivables amounting to $44,426. See note 3 for details of the new accounting policies.

BAHAMAS WASTE LIMITED ANNUAL REPORT 2018

15