Page 24 - Builder Brief September 2024 Issue

P. 24

HOME SALES / ECONOMY

SAN ANTONIO HOME SALES AND INVENTORY NOW AT PRE-PANDEMIC LEVELS

As of mid-2024, home sales in the San Antonio area have rebounded to levels seen before the pandemic, with an increasing supply of available properties.

This marks a significant change compared to the pandemic years when historically low mortgage rates led to soaring sales and prices, a dramatic drop in inventory, and buyers often found themselves in fierce bidding wars to secure a property—if they could locate one at all.

However, the Federal Reserve's efforts to combat inflation have caused mortgage rates to rise, and plummeting affordability due to soaring prices has left many prospective buyers on the sidelines. Simultaneously, existing homeowners with lower-rate mortgages are hesitant to sell and upgrade, further dampening the housing market. Additionally, some potential buyers are waiting to make significant financial commitments until after the upcoming November elections.

In both San Antonio and across the country, the slowing market has altered the dynamics for both buyers and sellers.

Returning to Pre-Pandemic Levels

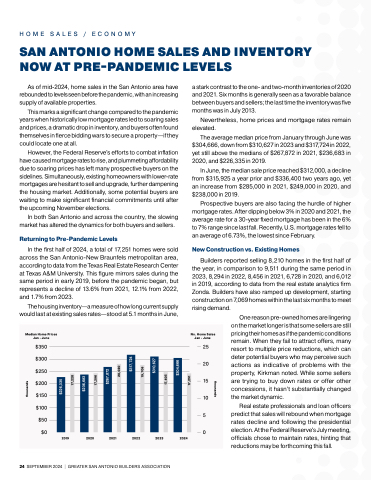

In the first half of 2024, a total of 17,251 homes were sold across the San Antonio-New Braunfels metropolitan area, according to data from the Texas Real Estate Research Center at Texas A&M University. This figure mirrors sales during the same period in early 2019, before the pandemic began, but represents a decline of 13.6% from 2021, 12.1% from 2022, and 1.7% from 2023.

The housing inventory—a measure of how long current supply would last at existing sales rates—stood at 5.1 months in June,

a stark contrast to the one- and two-month inventories of 2020 and 2021. Six months is generally seen as a favorable balance between buyers and sellers; the last time the inventory was five months was in July 2013.

Nevertheless, home prices and mortgage rates remain elevated.

The average median price from January through June was $304,666, down from $310,627 in 2023 and $317,724 in 2022, yet still above the medians of $267,872 in 2021, $236,683 in 2020, and $226,335 in 2019.

In June, the median sale price reached $312,000, a decline from $315,925 a year prior and $336,400 two years ago, yet an increase from $285,000 in 2021, $249,000 in 2020, and $238,000 in 2019.

Prospective buyers are also facing the hurdle of higher mortgage rates. After dipping below 3% in 2020 and 2021, the average rate for a 30-year fixed mortgage has been in the 6% to 7% range since last fall. Recently, U.S. mortgage rates fell to an average of 6.73%, the lowest since February.

New Construction vs. Existing Homes

Builders reported selling 8,210 homes in the first half of the year, in comparison to 9,511 during the same period in 2023, 8,294 in 2022, 8,456 in 2021, 6,728 in 2020, and 6,012 in 2019, according to data from the real estate analytics firm Zonda. Builders have also ramped up development, starting construction on 7,069 homes within the last six months to meet rising demand.

One reason pre-owned homes are lingering on the market longer is that some sellers are still pricing their homes as if the pandemic conditions remain. When they fail to attract offers, many resort to multiple price reductions, which can deter potential buyers who may perceive such actions as indicative of problems with the property, Kirkman noted. While some sellers are trying to buy down rates or offer other concessions, it hasn’t substantially changed the market dynamic.

Real estate professionals and loan officers predict that sales will rebound when mortgage rates decline and following the presidential election. At the Federal Reserve's July meeting, officials chose to maintain rates, hinting that reductions may be forthcoming this fall.

Median Home Prices Jan - June

$350

$300

$250

$200

$150

$100

$50 $0

No. Home Sales Jan - June

25 20 15 10 5 0

2019

2020

2021

2022

2023

2024

$226,335

thousands

$317,724

$310,627

$304,666

19,706

$267,872

20,

17,605

$236,683

1

1

thousands

7,228

7,296

020

17,251

24 SEPTEMBER 2024 | GREATER SAN ANTONIO BUILDERS ASSOCIATION