Page 90 - Food Outlook

P. 90

84

FOOD OUTLOOK NOVEMBER 2017

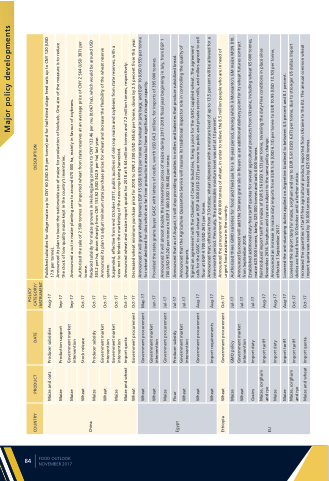

COUNTRY

PRODUCT

DATE

POLICY

CATEGORY/ DESCRIPTION

China

Maize

Producer subsidy

tonne.

Oct-17 Reduced subsidy for maize growers in Heilongjiang province to CNY 133.46 per mu (0.067 ha), which would be around USD

Egypt

Producer subsidy

Jul-17 Announced that as of August, it will stop providing subsidies to millers and bakeries that produce subsidized bread.

Ethiopia

Wheat Maize Wheat

Government

procurement market

Oct-17

EU

November 2014. Sorghum and rye are subject to the same policy change.

Aug-17 Announced an increase in maize duty imports from EUR 5.16 (USD 6.13) per tonne to EUR 10.95 (USD 13.10) per tonne,

Maize and oats Maize

Maize

Wheat

Producer subsidies

INSTRUMENT Aug-17

Published subsidies for silage maize up to CNY 60 (USD 8.9 per tonne) and for half-dried silage feed oats up to CNY 120 (USD 17.9 per tonne).

Announced its plan to boost the nationwide use of maize for production of biofuels. One aim of the measure is to reduce the stock of low quality maize kept in the country’s inventories.

Wheat

Government market intervention Government market intervention

303.2 per ha, down sharply from CNY 153.92 (USD 342.9 per ha) last year.

Oct-17 Announced its plan to adjust minimum state purchase prices for wheat and increase the flexibility of the wheat reserve

Maize

system.

Oct-17 Suspended, effective from end October 2017, public auctions of old-crop maize and soybeans from state reserves, with a

Maize and wheat Wheat

Import quota Government procurement

view not to hinder the marketing of the new crop being harvested.

Oct-17 Announced wheat and maize import quotas for 2018 at 9.64 million tonnes and 7.2 million tonnes, respectively.

Oct-17 Decreased wheat minimum purchase price for 2018 to CNR 2 300 (USD 345.6) per tonne, down by 2.5 percent from this year.

Wheat Wheat

Government procurement

Announced it will grant wheat farmers EGP 15 (USD 0.83) per tonne for wheat in jute bags, and EGP 10 (USD 0.55) per tonne for wheat destined for silos which are far from production areas but have significant storage capacity.

Maize Flour Wheat

Government procurement

Jul-17

Announced it will almost double the intervention prices of maize during 2017-2018 fiscal year beginning in July, from EGP 1 700 (USD 95.24) per tonne to EGP 3 400 (USD 190.48) per tonne.

Wheat

Government procurement Import requirements

Signed an agreement with the Chamber of Cereal Industries, fixing a price for the GASC supplied wheat. The agreement Aug-17 calls for the GASC to sell wheat at EGP 4 000 (USD 227) per tonne to public and private sector mills, and millers agreed to sell

Wheat

Aug-17

flour at EGP 4 700 (USD 267) per tonne.

Announced that, effective from 3 October, wheat shipments with a moisture level of up to 13.5 percent will be allowed for a nine-month period. Previously, the permissible moisture level was set at 13 percent.

Announced the procurement of 400 000 tonnes of wheat, in order to relieve the 8.5 million people who are in need of urgent food assistance in the country.

Grains

Import duty Import tariff

Jul-17

Established additional duty-free tariff quotas for several agricultural products from Ukraine, including wheat 65 000 tonnes,

Maize, and rye

maize 625 000 tonnes, barley 325 000 tonnes and oats 4 000 tonnes.

Aug-17 Reintroduced import tariff on maize of EUR 5.16 (USD 6.13) per tonne, reversing the duty-free conditions in place since

Maize

Import duty Import tariff Import tariff

effective 1 September 2017.

Maize

Aug-17 Lowered the anti-dumping duties applied on Argentine biodiesel to between 4.5 percent and 8.1 percent.

sorghum

Maize, sorghum and rye

Oct-17 Lowered the import duty for maize, sorghum and rye to EUR 5.61 (USD 6.07) per tonne, due to stronger US dollar. Import duties are fixed from 10 October until a further notice.

Maize and wheat

Import quota

Oct-17

Increased the quantities of tariff-free agricultural products exported from Ukraine to the EU. The annual common wheat import quota was raised by 16 000 tonnes and maize by 625 000 tonnes.

Production support

Sep-17

Sep-17 Announced a cut in maize planting area to around 670 000 ha, mainly in favour of soybeans.

Government market intervention

Stock release

Oct-17

Authorized the sale of 2 500 tonnes of imported wheat from state reserves at an average price of CNY 2 564 (USD 387) per

Government market intervention

May-17

Jun-17 Provided the state grains buyer GASC with letters of credit, worth USD 64.3 million, for imports of 395 000 tonnes.

Government market intervention

Jul-17 Announced that the Agriculture Quarantine Service will resume its traditional inspector role in controlling the quality of wheat imports.

GMO policy

Jul-17 Authorized three GMO varieties for food and feed use for a 10-year period, among which is Monsanto’s GM maize MON 810.

Government intervention

Jul-17 Announced Euronext will add the Simarex grain silo in Rouen as an additional delivery point for its wheat futures contract from September 2018.

Major policy developments