Page 173 - September 2022

P. 173

“If you are relying on money saved up in the bank to last you through your retirement, you will be surprised to see how fast it runs out.”

FINANCIAL PLANNING

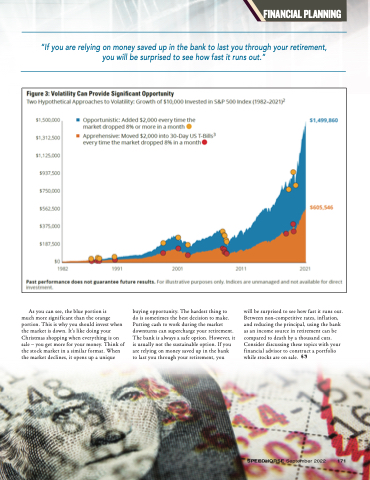

As you can see, the blue portion is

much more significant than the orange portion. This is why you should invest when the market is down. It’s like doing your Christmas shopping when everything is on

buying opportunity. The hardest thing to

do is sometimes the best decision to make. Putting cash to work during the market downturns can supercharge your retirement. The bank is always a safe option. However, it

will be surprised to see how fast it runs out. Between non-competitive rates, inflation, and reducing the principal, using the bank as an income source in retirement can be compared to death by a thousand cuts.

sale – you get more for your money. Think of the stock market in a similar format. When the market declines, it opens up a unique

is usually not the sustainable option. If you are relying on money saved up in the bank to last you through your retirement, you

Consider discussing these topics with your financial advisor to construct a portfolio while stocks are on sale.

SPEEDHORSE September 2022 171