Page 24 - Personal Underwriting Mandates & Guidelines - Binder Addendums - Version 3

P. 24

4 Personal Underwriting Mandates & Guidelines – Binder Addendums – Version 3

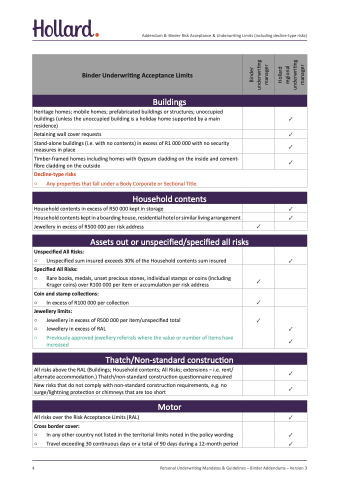

Addendum B: Binder Risk Acceptance & Underwriting Limits (including decline-type risks)

Binder Underwriting Acceptance Limits

Binder

underwriting

manager

Hollard

regional

underwriting

manager

Buildings

Heritage homes; mobile homes; prefabricated buildings or structures; unoccupied

buildings (unless the unoccupied building is a holiday home supported by a main

residence)

✓

Retaining wall cover requests ✓

Stand-alone buildings (i.e. with no contents) in excess of R1 000 000 with no security

measures in place ✓

Timber-framed homes including homes with Gypsum cladding on the inside and cement-

fibre cladding on the outside ✓

Decline-type risks

○ Any properties that fall under a Body Corporate or Sectional Title.

Household contents

Household contents in excess of R50 000 kept in storage ✓

Household contents kept in a boarding house, residential hotel or similar living arrangement ✓

Jewellery in excess of R500 000 per risk address ✓

Assets out or unspecified/specified all risks

Unspecified All Risks:

○ Unspecified sum insured exceeds 30% of the Household contents sum insured ✓

Specified All Risks:

○ Rare books, medals, unset precious stones, individual stamps or coins (including

Kruger coins) over R100 000 per item or accumulation per risk address ✓

Coin and stamp collections:

○ In excess of R100 000 per collection ✓

Jewellery limits:

○ Jewellery in excess of R500 000 per item/unspecified total ✓

○ Jewellery in excess of RAL ✓

○ Previously approved jewellery referrals where the value or number of items have

increased ✓

Thatch/Non-standard construction

All risks above the RAL (Buildings; Household contents; All Risks; extensions – i.e. rent/

alternate accommodation.) Thatch/non-standard construction questionnaire required ✓

New risks that do not comply with non-standard construction requirements, e.g. no

surge/lightning protection or chimneys that are too short ✓

Motor

All risks over the Risk Acceptance Limits (RAL) ✓

Cross border cover:

○ In any other country not listed in the territorial limits noted in the policy wording ✓

○ Travel exceeding 30 continuous days or a total of 90 days during a 12-month period ✓