Page 25 - AreaNewsletters "Jan 2022" issue

P. 25

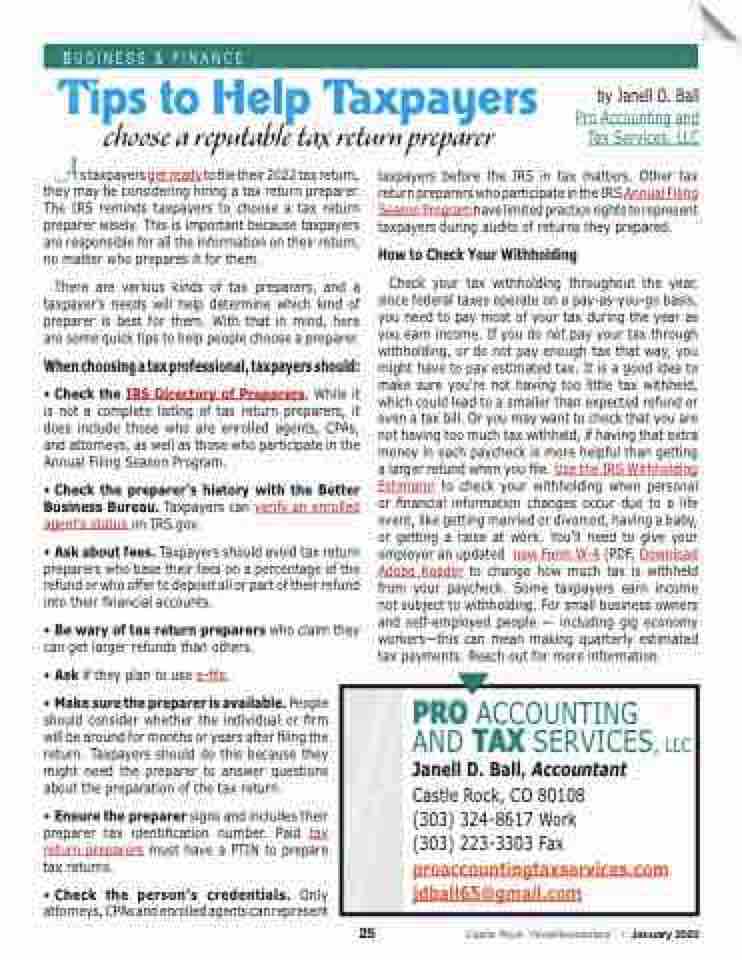

B US I N E S S & F I N A N C E Tips to Help Taxpayers choose a reputable tax return preparer by Janell D. Ball Pro Accounting and Tax Services, LLC A There are various kinds of tax preparers, and a taxpayer’s needs will help determine which kind of preparer is best for them. With that in mind, here are some quick tips to help people choose a preparer. Whenchoosingataxprofessional,taxpayersshould: • Check the IRS Directory of Preparers. While it is not a complete listing of tax return preparers, it does include those who are enrolled agents, CPAs, and attorneys, as well as those who participate in the Annual Filing Season Program. • Check the preparer’s history with the Better Business Bureau. Taxpayers can verify an enrolled agent’s status on IRS.gov. • Ask about fees. Taxpayers should avoid tax return preparers who base their fees on a percentage of the refund or who offer to deposit all or part of their refund into their nancial accounts. • Be wary of tax return preparers who claim they can get larger refunds than others. • Ask if they plan to use e- le. • Make sure the preparer is available. People should consider whether the individual or rm will be around for months or years after ling the return. Taxpayers should do this because they might need the preparer to answer questions about the preparation of the tax return. • Ensure the preparer signs and includes their preparer tax identi cation number. Paid tax return preparers must have a PTIN to prepare tax returns. •Check the person’s credentials. Only attorneys, CPAs and enrolled agents can represent s taxpayers get ready to le their 2022 tax return, they may be considering hiring a tax return preparer. The IRS reminds taxpayers to choose a tax return preparer wisely. This is important because taxpayers are responsible for all the information on their return, no matter who prepares it for them. taxpayers before the IRS in tax matters. Other tax return preparers who participate in the IRS Annual Filing Season Program have limited practice rights to represent taxpayers during audits of returns they prepared. How to Check Your Withholding Check your tax withholding throughout the year, since federal taxes operate on a pay-as-you-go basis, you need to pay most of your tax during the year as you earn income. If you do not pay your tax through withholding, or do not pay enough tax that way, you might have to pay estimated tax. It is a good idea to make sure you’re not having too little tax withheld, which could lead to a smaller than expected refund or even a tax bill. Or you may want to check that you are not having too much tax withheld, if having that extra money in each paycheck is more helpful than getting a larger refund when you le. Use the IRS Withholding Estimator to check your withholding when personal or nancial information changes occur due to a life event, like getting married or divorced, having a baby, or getting a raise at work. You’ll need to give your employeranupdated newFormW-4(PDF,Download Adobe Reader to change how much tax is withheld from your paycheck. Some taxpayers earn income not subject to withholding. For small business owners and self-employed people — including gig economy workers—this can mean making quarterly estimated tax payments. Reach out for more information. PRO ACCOUNTING AND TAX SERVICES, LLC Janell D. Ball, Accountant Castle Rock, CO 80108 (303) 324-8617 Work (303) 223-3303 Fax proaccountingtaxservices.com jdball65@gmail.com 25 Castle Rock “AreaNewsletters” • January 2022