Page 19 - Board of Directors Orientation

P. 19

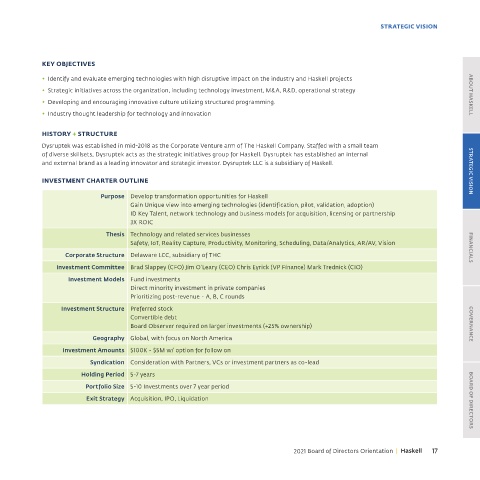

STRATEGIC VISION

KEY OBJECTIVES

◆ Identify and evaluate emerging technologies with high disruptive impact on the industry and Haskell projects

◆ Strategic initiatives across the organization, including technology investment, M&A, R&D, operational strategy ABOUT HASKELL

◆ Developing and encouraging innovative culture utilizing structured programming.

◆ Industry thought leadership for technology and innovation

HISTORY + STRUCTURE

Dysruptek was established in mid-2018 as the Corporate Venture arm of The Haskell Company. Staffed with a small team

of diverse skillsets, Dysruptek acts as the strategic initiatives group for Haskell. Dysruptek has established an internal

and external brand as a leading innovator and strategic investor. Dysruptek LLC is a subsidiary of Haskell.

INVESTMENT CHARTER OUTLINE STRATEGIC VISION

Purpose Develop transformation opportunities for Haskell

Gain Unique view into emerging technologies (identification, pilot, validation, adoption)

ID Key Talent, network technology and business models for acquisition, licensing or partnership

3X ROIC

Thesis Technology and related services businesses

Safety, IoT, Reality Capture, Productivity, Monitoring, Scheduling, Data/Analytics, AR/AV, Vision

Corporate Structure Delaware LCC, subsidiary of THC FINANCIALS

Investment Committee Brad Slappey (CFO) Jim O’Leary (CEO) Chris Eyrick (VP Finance) Mark Trednick (CIO)

Investment Models Fund investments

Direct minority investment in private companies

Prioritizing post-revenue - A, B, C rounds

Investment Structure Preferred stock

Convertible debt

Board Observer required on larger investments (+25% ownership) GOVERNANCE

Geography Global, with focus on North America

Investment Amounts $100K - $5M w/ option for follow on

Syndication Consideration with Partners, VCs or investment partners as co-lead

Holding Period 5-7 years

Portfolio Size 5-10 Investments over 7 year period

Exit Strategy Acquisition, IPO, Liquidation BOARD OF DIRECTORS

2021 Board of Directors Orientation | Haskell 17