Page 34 - Quality Industries

P. 34

Funding analysis

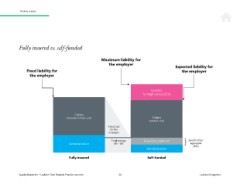

Fully Insured vs. Self-Funded

Fully insured vs. self-funded

Maximum liability for

the employer Expected liability for

Fixed liability for the employer

the employer

Corridor

for high claims (25%)

Claims

(included in fixed cost) Claims

(variable cost)

Fixed cost

for the

employer

Total savings Stop-loss premium Specific (ISL)/

Administration 3% – 5% aggregate

(ASL)

Administration

Fully insured Self-funded

2

Quality Industries — Lockton Total Rewards Practice overview 34 Lockton Companies

Fully Insured vs. Self-Funded

Fully insured vs. self-funded

Maximum liability for

the employer Expected liability for

Fixed liability for the employer

the employer

Corridor

for high claims (25%)

Claims

(included in fixed cost) Claims

(variable cost)

Fixed cost

for the

employer

Total savings Stop-loss premium Specific (ISL)/

Administration 3% – 5% aggregate

(ASL)

Administration

Fully insured Self-funded

2

Quality Industries — Lockton Total Rewards Practice overview 34 Lockton Companies