Page 40 - Post Acute Medical

P. 40

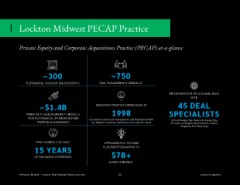

Lockton Midwest PECAP Practice

Private Equity and Corporate Acquisitions Practice (PECAP) at-a-glance

~300 ~750

PE/FINANCIAL SPONSOR RELATIONSHIPS DEAL ENGAGEMENTS ANNUALLY

WE CAN EXECUTE ON A GLOBAL BASIS

WITH

~$1.4B DEDICATED PRACTICE ESTABLISHED IN 45 DEAL

PREMIUM PLACED IN MARKET ANNUALLY 1998 SPECIALISTS

(FOR PE/FINANCIAL SPONSOR-BACKED to provide insurance, risk management, and employee beneits in the following cities: New York, Kansas City,

PORTFOLIO COMPANIES) due diligence to private equity irms and corporate clients St. Louis, Los Angeles, San Francisco, London,

Singapore, and Hong Kong

PROFESSIONALS AVERAGE APPROXIMATELY 370 R&W

15 YEARS PLACEMENTS EQUATING TO

OF INSURANCE EXPERIENCE $7B+

LIMITS ANNUALLY

Post Acute Medical — Lockton Total Rewards Practice overview 40 Lockton Companies

Private Equity and Corporate Acquisitions Practice (PECAP) at-a-glance

~300 ~750

PE/FINANCIAL SPONSOR RELATIONSHIPS DEAL ENGAGEMENTS ANNUALLY

WE CAN EXECUTE ON A GLOBAL BASIS

WITH

~$1.4B DEDICATED PRACTICE ESTABLISHED IN 45 DEAL

PREMIUM PLACED IN MARKET ANNUALLY 1998 SPECIALISTS

(FOR PE/FINANCIAL SPONSOR-BACKED to provide insurance, risk management, and employee beneits in the following cities: New York, Kansas City,

PORTFOLIO COMPANIES) due diligence to private equity irms and corporate clients St. Louis, Los Angeles, San Francisco, London,

Singapore, and Hong Kong

PROFESSIONALS AVERAGE APPROXIMATELY 370 R&W

15 YEARS PLACEMENTS EQUATING TO

OF INSURANCE EXPERIENCE $7B+

LIMITS ANNUALLY

Post Acute Medical — Lockton Total Rewards Practice overview 40 Lockton Companies