Page 4 - Summit BHC 2022 Benefits Guide Pavilion and Farley Center

P. 4

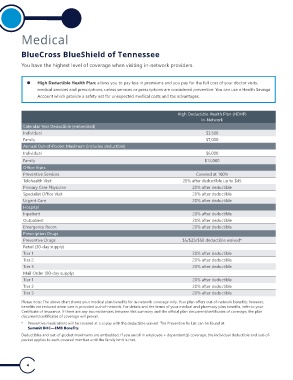

Medical

BlueCross BlueShield of Tennessee

You have the highest level of coverage when visiting in-network providers.

z High Deductible Health Plan: allows you to pay less in premiums and you pay for the full cost of your doctor visits,

medical services and prescriptions, unless services or prescriptions are considered preventive. You can use a Health Savings

Account which provide a safety net for unexpected medical costs and tax advantages.

High Deductible Health Plan (HDHP)

In-Network

Calendar Year Deductible (embedded)

Individual $3,500

Family $7,000

Annual Out-of-Pocket Maximum (includes deductible)

Individual $6,000

Family $12,000

Oice Visits

Preventive Services Covered at 100%

Telehealth Visit 20% after deductible up to $45

Primary Care Physician 20% after deductible

Specialist Oice Visit 20% after deductible

Urgent Care 20% after deductible

Hospital

Inpatient 20% after deductible

Outpatient 20% after deductible

Emergency Room 20% after deductible

Prescription Drugs

Preventive Drugs $5/$25/$50 deductible waived*

Retail (30-day supply)

Tier 1 20% after deductible

Tier 2 20% after deductible

Tier 3 20% after deductible

Mail Order (90-day supply)

Tier 1 20% after deductible

Tier 2 20% after deductible

Tier 3 20% after deductible

Please note: The above chart shows your medical plan beneits for in-network coverage only. Your plan ofers out-of-network beneits; however,

beneits are reduced when care is provided out-of-network. For details and the terms of your medical and pharmacy plan beneits, refer to your

Certiicate of Insurance. If there are any inconsistencies between this summary and the oicial plan document/certiicates of coverage, the plan

document/certiicates of coverage will prevail.

* Preventive medications will be covered at a copay with the deductible waived. The Preventive Rx List can be found at

Summit BHC—EMB Beneits.

Deductibles and out-of-pocket maximums are embedded. If you enroll in employee + dependent(s) coverage, the individual deductible and out-of-

pocket applies to each covered member until the family limit is met.

4

BlueCross BlueShield of Tennessee

You have the highest level of coverage when visiting in-network providers.

z High Deductible Health Plan: allows you to pay less in premiums and you pay for the full cost of your doctor visits,

medical services and prescriptions, unless services or prescriptions are considered preventive. You can use a Health Savings

Account which provide a safety net for unexpected medical costs and tax advantages.

High Deductible Health Plan (HDHP)

In-Network

Calendar Year Deductible (embedded)

Individual $3,500

Family $7,000

Annual Out-of-Pocket Maximum (includes deductible)

Individual $6,000

Family $12,000

Oice Visits

Preventive Services Covered at 100%

Telehealth Visit 20% after deductible up to $45

Primary Care Physician 20% after deductible

Specialist Oice Visit 20% after deductible

Urgent Care 20% after deductible

Hospital

Inpatient 20% after deductible

Outpatient 20% after deductible

Emergency Room 20% after deductible

Prescription Drugs

Preventive Drugs $5/$25/$50 deductible waived*

Retail (30-day supply)

Tier 1 20% after deductible

Tier 2 20% after deductible

Tier 3 20% after deductible

Mail Order (90-day supply)

Tier 1 20% after deductible

Tier 2 20% after deductible

Tier 3 20% after deductible

Please note: The above chart shows your medical plan beneits for in-network coverage only. Your plan ofers out-of-network beneits; however,

beneits are reduced when care is provided out-of-network. For details and the terms of your medical and pharmacy plan beneits, refer to your

Certiicate of Insurance. If there are any inconsistencies between this summary and the oicial plan document/certiicates of coverage, the plan

document/certiicates of coverage will prevail.

* Preventive medications will be covered at a copay with the deductible waived. The Preventive Rx List can be found at

Summit BHC—EMB Beneits.

Deductibles and out-of-pocket maximums are embedded. If you enroll in employee + dependent(s) coverage, the individual deductible and out-of-

pocket applies to each covered member until the family limit is met.

4