Page 54 - IVX Health

P. 54

Infolock

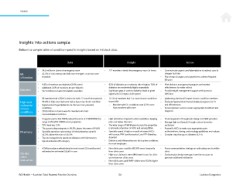

Insights into actions sample

Below is a sample table of condition-speciic insights based on Infolock data.

Data Insight Action

• $4.5 million in claims at emergency room • 227 members visited the emergency room 3+ times • Communicate urgent care/telemedicine to redirect care to

ER • 42.3% of visits were potentially non-emergent or primary care cheaper facilities

utilization treatable • Plan design changes can be punitive to address frequent

ER users

• 9.4% of members are diabetics (5.8% norm) • 82% of diabetics are moderate risk or higher; 74% of • Pilot diabetes management program and monitor

• Additional 3.6% of members are pre-diabetic diabetics are moderately/highly impactable effectiveness for wider rollout

Diabetes • $17.6 million in claims for diabetic members • Signiicant gaps in care for diabetics leads to great • Provide weight management support with access to

opportunity to impact claim spend dietitians

• 89 members had >$50K in claims for both 12-month time periods • 10.1% of members had 3 or more chronic conditions • Addressing obesity will impact chronic condition members

High-cost • 90.4% of high-cost claimants had at least one chronic condition (norm 8%) • Evaluate hypertension/musculoskeletal programs for it

claimants/ • Hypertension/hyperlipidemia are the two most prevalent − Members with 3+ conditions cost 12.9× more and effectiveness

chronic conditions than members with none • Second opinion services ensure appropriate treatment and

conditions • $38.8 million in claims were for members who had diagnosis

musculoskeletal condition

• Drug plan paid is $93 PMPM, below the norm of $100 PMPM; the • High utilization of generics when available is keeping • Promote generics through plan design and DAW penalties

range is $76-$151 PMPM across properties plan cost below the norm • Manage high-cost brands through custom formulary

• YOY trend was 11% • The wide range of PMPM spend across the properties exclusions

• The generic dispensing rate is 86.5%, above the norm of 84.6% is primarily a function of HCCs and varying PBMs • Review Rx HCCs to make sure appropriate prior

Pharmacy • Specialty spend as a percentage of total pharmacy spend is • Specialty spend is high as a result of several HCCs authorizations, dosing, and oncology guidelines are in place

54.2%, above the norm of 45.5% with cancer, PAH (cardiovascular), and ITP (bleeding • Consider step therapy on diabetes GLP-1s

• Top two categories by spend are diabetes and inlammatory disorder)

• Opioid utilization #5 category • Diabetes and inlammatory are the top two conditions

for most employers

• 4,769 procedures administered in most recent 12-month period • Non-clinic users used the ER 59% more frequently • Focus communication strategy on redirecting care to within

redirected an estimated $556K in care than clinic users clinic

On-site • High-cost claimants were 48% lower in cost for clinic • Evaluate plan design steerage, incentive structure to

clinic users than non-clinic users generate additional utilization

evaluation • Non-clinic users paid PMPY claims were 55.6% higher

than clinic users

IVX Health — Lockton Total Rewards Practice Overview 54 Lockton Companies

Insights into actions sample

Below is a sample table of condition-speciic insights based on Infolock data.

Data Insight Action

• $4.5 million in claims at emergency room • 227 members visited the emergency room 3+ times • Communicate urgent care/telemedicine to redirect care to

ER • 42.3% of visits were potentially non-emergent or primary care cheaper facilities

utilization treatable • Plan design changes can be punitive to address frequent

ER users

• 9.4% of members are diabetics (5.8% norm) • 82% of diabetics are moderate risk or higher; 74% of • Pilot diabetes management program and monitor

• Additional 3.6% of members are pre-diabetic diabetics are moderately/highly impactable effectiveness for wider rollout

Diabetes • $17.6 million in claims for diabetic members • Signiicant gaps in care for diabetics leads to great • Provide weight management support with access to

opportunity to impact claim spend dietitians

• 89 members had >$50K in claims for both 12-month time periods • 10.1% of members had 3 or more chronic conditions • Addressing obesity will impact chronic condition members

High-cost • 90.4% of high-cost claimants had at least one chronic condition (norm 8%) • Evaluate hypertension/musculoskeletal programs for it

claimants/ • Hypertension/hyperlipidemia are the two most prevalent − Members with 3+ conditions cost 12.9× more and effectiveness

chronic conditions than members with none • Second opinion services ensure appropriate treatment and

conditions • $38.8 million in claims were for members who had diagnosis

musculoskeletal condition

• Drug plan paid is $93 PMPM, below the norm of $100 PMPM; the • High utilization of generics when available is keeping • Promote generics through plan design and DAW penalties

range is $76-$151 PMPM across properties plan cost below the norm • Manage high-cost brands through custom formulary

• YOY trend was 11% • The wide range of PMPM spend across the properties exclusions

• The generic dispensing rate is 86.5%, above the norm of 84.6% is primarily a function of HCCs and varying PBMs • Review Rx HCCs to make sure appropriate prior

Pharmacy • Specialty spend as a percentage of total pharmacy spend is • Specialty spend is high as a result of several HCCs authorizations, dosing, and oncology guidelines are in place

54.2%, above the norm of 45.5% with cancer, PAH (cardiovascular), and ITP (bleeding • Consider step therapy on diabetes GLP-1s

• Top two categories by spend are diabetes and inlammatory disorder)

• Opioid utilization #5 category • Diabetes and inlammatory are the top two conditions

for most employers

• 4,769 procedures administered in most recent 12-month period • Non-clinic users used the ER 59% more frequently • Focus communication strategy on redirecting care to within

redirected an estimated $556K in care than clinic users clinic

On-site • High-cost claimants were 48% lower in cost for clinic • Evaluate plan design steerage, incentive structure to

clinic users than non-clinic users generate additional utilization

evaluation • Non-clinic users paid PMPY claims were 55.6% higher

than clinic users

IVX Health — Lockton Total Rewards Practice Overview 54 Lockton Companies