Page 4 - 2020AONBenefitGuide

P. 4

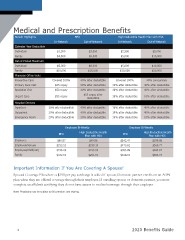

Medical and Prescription Benefits

Beneit Highlights PPO High Deductible Health Plan with HSA

In-Network Out-of-Network In-Network Out-of-Network

Calendar Year Deductible

Individual $1,500 $3,000 $2,500 $5,000

Family $4,500 $9,000 $5,000 $10,000

Out-of-Pocket Maximum

Individual $5,000 $8,000 $5,000 $10,000

Family $10,000 $16,000 $10,000 $20,000

Physician Oice Visits

Preventive Care Covered 100% 40% after deductible Covered 100% 40% coinsurance

Primary Care Visit $25 copay 40% after deductible 10% after deductible 40% after deductible

Specialist Visit $50 copay 40% after deductible 10% after deductible 40% after deductible

Urgent Care $55 copay $55 copay after 10% after deductible 10% after deductible

deductible

Hospital Services

Inpatient 20% after deductible 40% after deductible 10% after deductible 40% after deductible

Outpatient 20% after deductible 40% after deductible 10% after deductible 40% after deductible

Emergency Room 20% after deductible 20% after deductible 10% after deductible 10% after deductible

Employee Bi-Weekly Employer Bi-Weekly

PPO High Deductible Health PPO High Deductible Health

Plan with HSA

Plan with HSA

Employee $60.87 $49.96 $243.47 $199.85

Employee/Spouse $253.51 $199.10 $470.81 $369.77

Employee/Child(ren) $196.00 $153.93 $363.99 $285.87

Family $332.63 $261.01 $616.91 $484.73

Important Information If You Are Covering A Spouse!

Spousal Coverage Elsewhere: a $150 per pay surcharge is added if spouse/domestic partner enrolls on an AON

plan when they are offered coverage through their employer. If enrolling spouse or domestic partner, you must

complete an afidavit certifying they do not have access to medical coverage through their employer.

Note: Physicians may be subject to full premium cost sharing.

4 2020 Benefits Guide

Beneit Highlights PPO High Deductible Health Plan with HSA

In-Network Out-of-Network In-Network Out-of-Network

Calendar Year Deductible

Individual $1,500 $3,000 $2,500 $5,000

Family $4,500 $9,000 $5,000 $10,000

Out-of-Pocket Maximum

Individual $5,000 $8,000 $5,000 $10,000

Family $10,000 $16,000 $10,000 $20,000

Physician Oice Visits

Preventive Care Covered 100% 40% after deductible Covered 100% 40% coinsurance

Primary Care Visit $25 copay 40% after deductible 10% after deductible 40% after deductible

Specialist Visit $50 copay 40% after deductible 10% after deductible 40% after deductible

Urgent Care $55 copay $55 copay after 10% after deductible 10% after deductible

deductible

Hospital Services

Inpatient 20% after deductible 40% after deductible 10% after deductible 40% after deductible

Outpatient 20% after deductible 40% after deductible 10% after deductible 40% after deductible

Emergency Room 20% after deductible 20% after deductible 10% after deductible 10% after deductible

Employee Bi-Weekly Employer Bi-Weekly

PPO High Deductible Health PPO High Deductible Health

Plan with HSA

Plan with HSA

Employee $60.87 $49.96 $243.47 $199.85

Employee/Spouse $253.51 $199.10 $470.81 $369.77

Employee/Child(ren) $196.00 $153.93 $363.99 $285.87

Family $332.63 $261.01 $616.91 $484.73

Important Information If You Are Covering A Spouse!

Spousal Coverage Elsewhere: a $150 per pay surcharge is added if spouse/domestic partner enrolls on an AON

plan when they are offered coverage through their employer. If enrolling spouse or domestic partner, you must

complete an afidavit certifying they do not have access to medical coverage through their employer.

Note: Physicians may be subject to full premium cost sharing.

4 2020 Benefits Guide