Page 206 - SALIK PR REPORT JANUARY 2024

P. 206

1/3/24, 11:08 AM How world sees GCC: Region's sovereign wealth funds on the rise

Abu Dhabi and Saudi Approach:

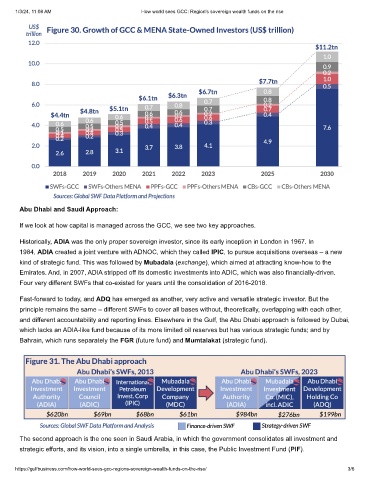

If we look at how capital is managed across the GCC, we see two key approaches.

Historically, ADIA was the only proper sovereign investor, since its early inception in London in 1967. In

1984, ADIA created a joint venture with ADNOC, which they called IPIC, to pursue acquisitions overseas – a new

kind of strategic fund. This was followed by Mubadala (exchange), which aimed at attracting know-how to the

Emirates. And, in 2007, ADIA stripped off its domestic investments into ADIC, which was also financially-driven.

Four very different SWFs that co-existed for years until the consolidation of 2016-2018.

Fast-forward to today, and ADQ has emerged as another, very active and versatile strategic investor. But the

principle remains the same – different SWFs to cover all bases without, theoretically, overlapping with each other,

and different accountability and reporting lines. Elsewhere in the Gulf, the Abu Dhabi approach is followed by Dubai,

which lacks an ADIA-like fund because of its more limited oil reserves but has various strategic funds; and by

Bahrain, which runs separately the FGR (future fund) and Mumtalakat (strategic fund).

The second approach is the one seen in Saudi Arabia, in which the government consolidates all investment and

strategic efforts, and its vision, into a single umbrella, in this case, the Public Investment Fund (PIF).

https://gulfbusiness.com/how-world-sees-gcc-regions-sovereign-wealth-funds-on-the-rise/ 3/6