Page 32 - UNION PROPERTIES PR REPORT - September 2025

P. 32

9/11/25, 11:18 AM Ras Al Khaimah Business Insights | Latest News & Investment Trends

Posted on 10-9-2025 10:36:45

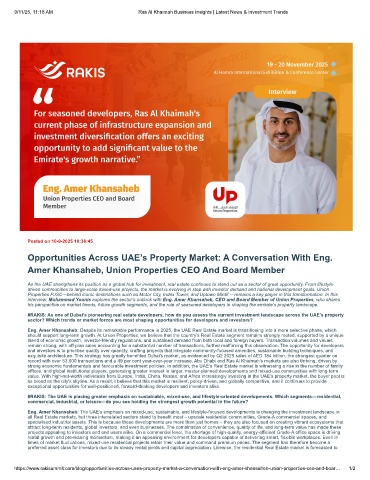

Opportunities Across UAE’s Property Market: A Conversation With Eng.

Amer Khansaheb, Union Properties CEO And Board Member

As the UAE strengthens its position as a global hub for investment, real estate continues to stand out as a sector of great opportunity. From lifestyle-

driven communities to large-scale mixed-use projects, the market is evolving in step with investor demand and national development goals. Union

Properties PJSC—behind iconic destinations such as Motor City, Index Tower, and Uptown Mirdif —remains a key player in this transformation. In this

interview, Muhammad Younis explores the sector’s outlook with Eng. Amer Khansaheb, CEO and Board Member of Union Properties, who shares

his perspective on market trends, future growth segments, and the role of seasoned developers in shaping the emirate’s property landscape.

#RAKIS: As one of Dubai’s pioneering real estate developers, how do you assess the current investment landscape across the UAE’s property

sector? Which trends or market forces are most shaping opportunities for developers and investors?

Eng. Amer Khansaheb: Despite its remarkable performance in 2025, the UAE Real Estate market is transitioning into a more selective phase, which

should support long-term growth. At Union Properties, we believe that the country’s Real Estate segment remains strongly rooted, supported by a unique

blend of economic growth, investor-friendly regulations, and sustained demand from both local and foreign buyers. Transaction volumes and values

remain strong, with off-plan sales accounting for a substantial number of transactions, further reaffirming this observation. The opportunity for developers

and investors is to prioritise quality over quantity, crafting projects that integrate community-focused amenities, sustainable building techniques, and

exquisite architecture. This strategy has greatly benefited Dubai's market, as evidenced by Q2 2025 sales of AED 184 billion, the strongest quarter on

record with over 53,000 transactions and a 49 per cent year-over-year increase. Abu Dhabi and Ras Al Khaimah's markets are also thriving, driven by

strong economic fundamentals and favourable investment policies. In addition, the UAE’s Real Estate market is witnessing a rise in the number of family

offices, and global institutional players, generating greater interest in larger, master-planned developments and mixed-use communities with long-term

value. With high-net-worth individuals from Europe, India, China, Russia, and Africa increasingly investing in the UAE’s property market, the buyer pool is

as broad as the city's skyline. As a result, I believe that this market is resilient, policy-driven, and globally competitive, and it continues to provide

exceptional opportunities for well-positioned, forward-thinking developers and investors alike.

#RAKIS: The UAE is placing greater emphasis on sustainable, mixed-use, and lifestyle-oriented developments. Which segments—residential,

commercial, industrial, or leisure—do you see holding the strongest growth potential in the future?

Eng. Amer Khansaheb: The UAE's emphasis on mixed-use, sustainable, and lifestyle-focused developments is changing the investment landscape in

all Real Estate markets, but three interrelated sectors stand to benefit most – upscale residential communities, Grade-A commercial spaces, and

specialised industrial assets. This is because these developments are more than just homes – they are also focused on creating vibrant ecosystems that

attract long-term residents, global investors, and even businesses. The combination of convenience, quality of life, and long-term value has made these

projects appealing to investors and end users alike. On a commercial level, the shortage of high-quality, energy-efficient Grade-A office space is driving

rental growth and pre-leasing momentum, making it an appealing environment for developers capable of delivering smart, flexible workplaces. Even in

times of market fluctuations, mixed-use residential projects retain their value and command premium prices. The segment has therefore become a

preferred asset class for investors due to its steady rental yields and capital appreciation. Likewise, the residential Real Estate market is forecasted to

https://www.rakisummit.com/blog/opportunities-across-uaes-property-market-a-conversation-with-eng-amer-khansaheb-union-properties-ceo-and-boar… 1/2