Page 195 - SALIK PR REPORT AUGUST 2024

P. 195

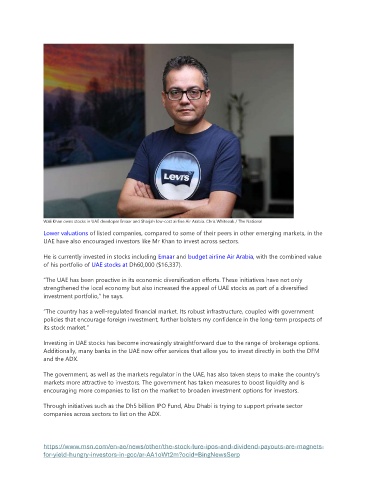

Wali Khan owns stocks in UAE developer Emaar and Sharjah low-cost airline Air Arabia. Chris Whiteoak / The National

Lower valuations of listed companies, compared to some of their peers in other emerging markets, in the

UAE have also encouraged investors like Mr Khan to invest across sectors.

He is currently invested in stocks including Emaar and budget airline Air Arabia, with the combined value

of his portfolio of UAE stocks at Dh60,000 ($16,337).

“The UAE has been proactive in its economic diversification efforts. These initiatives have not only

strengthened the local economy but also increased the appeal of UAE stocks as part of a diversified

investment portfolio,” he says.

“The country has a well-regulated financial market. Its robust infrastructure, coupled with government

policies that encourage foreign investment, further bolsters my confidence in the long-term prospects of

its stock market.”

Investing in UAE stocks has become increasingly straightforward due to the range of brokerage options.

Additionally, many banks in the UAE now offer services that allow you to invest directly in both the DFM

and the ADX.

The government, as well as the markets regulator in the UAE, has also taken steps to make the country's

markets more attractive to investors. The government has taken measures to boost liquidity and is

encouraging more companies to list on the market to broaden investment options for investors.

Through initiatives such as the Dh5 billion IPO Fund, Abu Dhabi is trying to support private sector

companies across sectors to list on the ADX.

https://www.msn.com/en-ae/news/other/the-stock-lure-ipos-and-dividend-payouts-are-magnets-

for-yield-hungry-investors-in-gcc/ar-AA1oWt2m?ocid=BingNewsSerp