Page 30 - AAE PR REPORT - JUNE 2025

P. 30

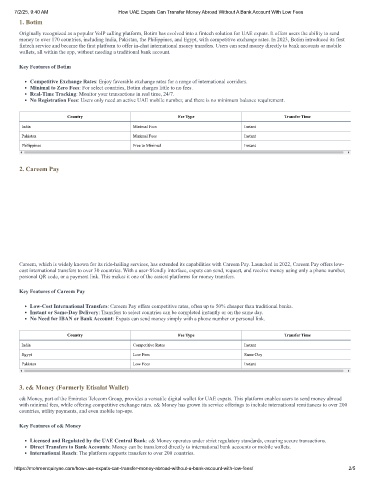

7/2/25, 9:40 AM How UAE Expats Can Transfer Money Abroad Without A Bank Account With Low Fees

1. Botim

Originally recognized as a popular VoIP calling platform, Botim has evolved into a fintech solution for UAE expats. It offers users the ability to send

money to over 170 countries, including India, Pakistan, the Philippines, and Egypt, with competitive exchange rates. In 2023, Botim introduced its first

fintech service and became the first platform to offer in-chat international money transfers. Users can send money directly to bank accounts or mobile

wallets, all within the app, without needing a traditional bank account.

Key Features of Botim

Competitive Exchange Rates: Enjoy favorable exchange rates for a range of international corridors.

Minimal to Zero Fees: For select countries, Botim charges little to no fees.

Real-Time Tracking: Monitor your transactions in real time, 24/7.

No Registration Fees: Users only need an active UAE mobile number, and there is no minimum balance requirement.

Country Fee Type Transfer Time

India Minimal Fees Instant

Pakistan Minimal Fees Instant

Philippines Free to Minimal Instant

2. Careem Pay

Careem, which is widely known for its ride-hailing services, has extended its capabilities with Careem Pay. Launched in 2022, Careem Pay offers low-

cost international transfers to over 30 countries. With a user-friendly interface, expats can send, request, and receive money using only a phone number,

personal QR code, or a payment link. This makes it one of the easiest platforms for money transfers.

Key Features of Careem Pay

Low-Cost International Transfers: Careem Pay offers competitive rates, often up to 50% cheaper than traditional banks.

Instant or Same-Day Delivery: Transfers to select countries can be completed instantly or on the same day.

No Need for IBAN or Bank Account: Expats can send money simply with a phone number or personal link.

Country Fee Type Transfer Time

India Competitive Rates Instant

Egypt Low Fees Same-Day

Pakistan Low Fees Instant

3. e& Money (Formerly Etisalat Wallet)

e& Money, part of the Emirates Telecom Group, provides a versatile digital wallet for UAE expats. This platform enables users to send money abroad

with minimal fees, while offering competitive exchange rates. e& Money has grown its service offerings to include international remittances to over 200

countries, utility payments, and even mobile top-ups.

Key Features of e& Money

Licensed and Regulated by the UAE Central Bank: e& Money operates under strict regulatory standards, ensuring secure transactions.

Direct Transfers to Bank Accounts: Money can be transferred directly to international bank accounts or mobile wallets.

International Reach: The platform supports transfers to over 200 countries.

https://mohreenquiryae.com/how-uae-expats-can-transfer-money-abroad-without-a-bank-account-with-low-fees/ 2/5