Page 15 - AAE PR REPORT - August 2024

P. 15

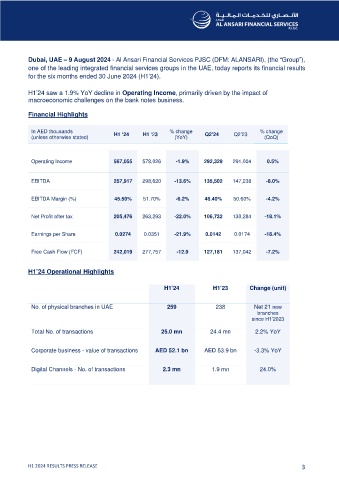

Dubai, UAE – 9 August 2024 - Al Ansari Financial Services PJSC (DFM: ALANSARI), (the “Group”),

one of the leading integrated financial services groups in the UAE, today reports its financial results

for the six months ended 30 June 2024 (H1’24).

H1’24 saw a 1.9% YoY decline in Operating Income, primarily driven by the impact of

macroeconomic challenges on the bank notes business.

Financial Highlights

In AED thousands H1 ‘24 H1 ‘23 % change Q2’24 Q2’23 % change

(unless otherwise stated) (YoY) (QoQ)

Operating Income 567,055 578,026 -1.9% 292,329 291,004 0.5%

EBITDA 257,917 298,620 -13.6% 135,502 147,238 -8.0%

EBITDA Margin (%) 45.50% 51.70% -6.2% 46.40% 50.60% -4.2%

Net Profit after tax 205,476 263,293 -22.0% 106,732 130,284 -18.1%

Earnings per Share 0.0274 0.0351 -21.9% 0.0142 0.0174 -18.4%

Free Cash Flow (FCF) 242,019 277,757 -12.9 127,181 137,042 -7.2%

H1’24 Operational Highlights

H1’24 H1’23 Change (unit)

No. of physical branches in UAE 259 238 Net 21 new

branches

since H1’2023

Total No. of transactions 25.0 mn 24.4 mn 2.2% YoY

Corporate business - value of transactions AED 52.1 bn AED 53.9 bn -3.3% YoY

Digital Channels - No. of transactions 2.3 mn 1.9 mn 24.0%

H1 2024 RESULTS PRESS RELEASE 3